Introduction

As a small business owner, having the right accounting software is crucial for managing finances, invoicing clients, tracking expenses and more. However, with so many options on the market, it can be difficult to decide which software is the best fit. In this blog, we will take an in-depth look at 15 of the top accounting solutions based on features, pricing, ease of use and other factors to help you choose the right one to grow your business in 2023.

Methods of Evaluation

To evaluate and rank the top 15 accounting software options, we considered several key factors: features and functionality, pricing and plans, ease of use, support and training available, integration capabilities, security, and popularity based on metrics like number of backlinks, traffic and keyword search trends. Functionality factors included invoicing, accounting, reporting, payroll, inventory management and more. We also reviewed platforms based on suitability for different business types and sizes. Companies were ranked based on overall score across these evaluation criteria.

1. Dropbox Business

Dropbox Business is a file hosting and sharing service that provides both individual and business users easy ways to access and share files from any device. While not strictly an accounting software, Dropbox offers many features that are useful for small businesses to simplify workflows and collaborate more effectively.

Pros: Some key advantages of Dropbox Business include:

– Secure file sharing and storage both internally within teams as well as externally.

– Simple organization of files and folders for easy navigation and retrieval.

– Powerful collaboration tools allowing teams to work together seamlessly on shared projects and files.

– Affordable pricing tiers starting from basic individual plans up to enterprise team offerings.

Cons: One potential disadvantage is that Dropbox is not specifically designed or marketed as accounting software. While it complements accounting workflows well for file organization and sharing, it lacks core accounting features for tasks like invoicing, expenses, payroll, etc.

Pricing: Dropbox Business offers various paid plans starting from $12.50 per user per month for the Standard plan which includes unlimited storage, file restores, sharing features and admin controls. Higher tiers like Advanced and Enterprise plans provide additional benefits like version history, e-signatures and IT controls.

Some key stats about Dropbox Business include:

– Over 500 million users globally across both individual and business plans.

– Available on Windows, Mac, iOS and Android as well as via any web browser.

– Unlimited online storage and file sharing across teams and multiple users.

– Version history and rollback allows retrieving older files and file states.

– Integrations with hundreds of third party apps including Google Drive, Slack, Microsoft 365 and more.

2. Shopify POS

Shopify POS is point-of-sale software developed by Shopify that allows merchants to take offline payments for products in physical retail stores. It offers retailers an integrated cash management solution that syncs with their online Shopify stores for a complete view of their business.

Pros: Some key advantages of Shopify POS include:

– Seamless add-on to online stores

– Multi-location and tablet support

– Instant payments processing

– Customizable interface

Cons: A potential disadvantage is the monthly subscription fee which can range from $39-299 depending on the plan and features needed.

Pricing: Shopify POS offers several pricing plans starting from $39 per month for single retail locations up to $299 per month for advanced plans with additional features like multiple locations and employee management.

Some key stats about Shopify POS include:

– Used by over 600,000 merchants worldwide

– Processes over $150 billion in payments annually

– Integrates seamlessly with Shopify online stores

– Available as both card readers and tablet/mobile POS systems

3. QuickBooks

QuickBooks is an accounting software developed by Intuit that helps small businesses and freelancers manage their finances. With over 4.5 million active subscribers, QuickBooks is one of the most popular accounting software for small businesses.

Pros: Some of the key advantages of QuickBooks include:

– Extremely user-friendly and intuitive interface that is easy for non-accountants to use

– Wide range of features for invoicing, expenses, payroll, inventory, and more

– Great support from Intuit with 24/7 phone, chat, and email support

– Integrates with lots of other apps commonly used by small businesses like credit card processors and e-commerce platforms

– Ability to track time, expenses, invoices, and accept payments online

Cons: A potential disadvantage of QuickBooks is its pricing – while it offers various subscription plans, the prices can be higher than some other accounting software options for very small businesses or sole proprietors with basic accounting needs.

Pricing: QuickBooks offers various subscription plans starting from $15-50/month depending on the features required. There are plans tailored for different types of businesses like service-based, contractors, manufacturers, etc. All plans include software upgrades, technical support, and secure cloud backups.

Some key stats about QuickBooks include:

– Over 4.5 million small businesses and freelancers use QuickBooks worldwide

– QuickBooks has been the #1 best-selling accounting software for small businesses for over 20 years

– QuickBooks integrates with over 3,000 third-party apps including Amazon, Dropbox, Shopify, and Xero

– QuickBooks offers its services in over 100 countries

4. SAP Business One

SAP Business One is an enterprise resource planning (ERP) software developed by German company SAP SE. It is designed to meet the needs of small and midsize organizations. SAP Business One provides an all-in-one solution for core business functions including accounting, sales, purchasing, inventory, and CRM.

Pros: Some key advantages of SAP Business One include:

– Full ERP solution that integrates core business processes

– Robust CRM and financial management capabilities

– Industry specific versions tailored to unique workflow needs

– Cloud deployment option for flexibility and scalability

Cons: A potential disadvantage is that as a full-fledged ERP solution, SAP Business One may have more features than necessary for some very small businesses, resulting in a higher total cost of ownership.

Pricing: SAP Business One pricing starts at around $100 per user per month depending on the number of users, modules, services, customizations and other factors. Both perpetual and subscription license models are available.

Some key stats about SAP Business One include:

– Used by over 40,000 customers worldwide across various industries

– Available in 25 languages

– Industry specific versions for wholesale distribution, services industries, manufacturing and more

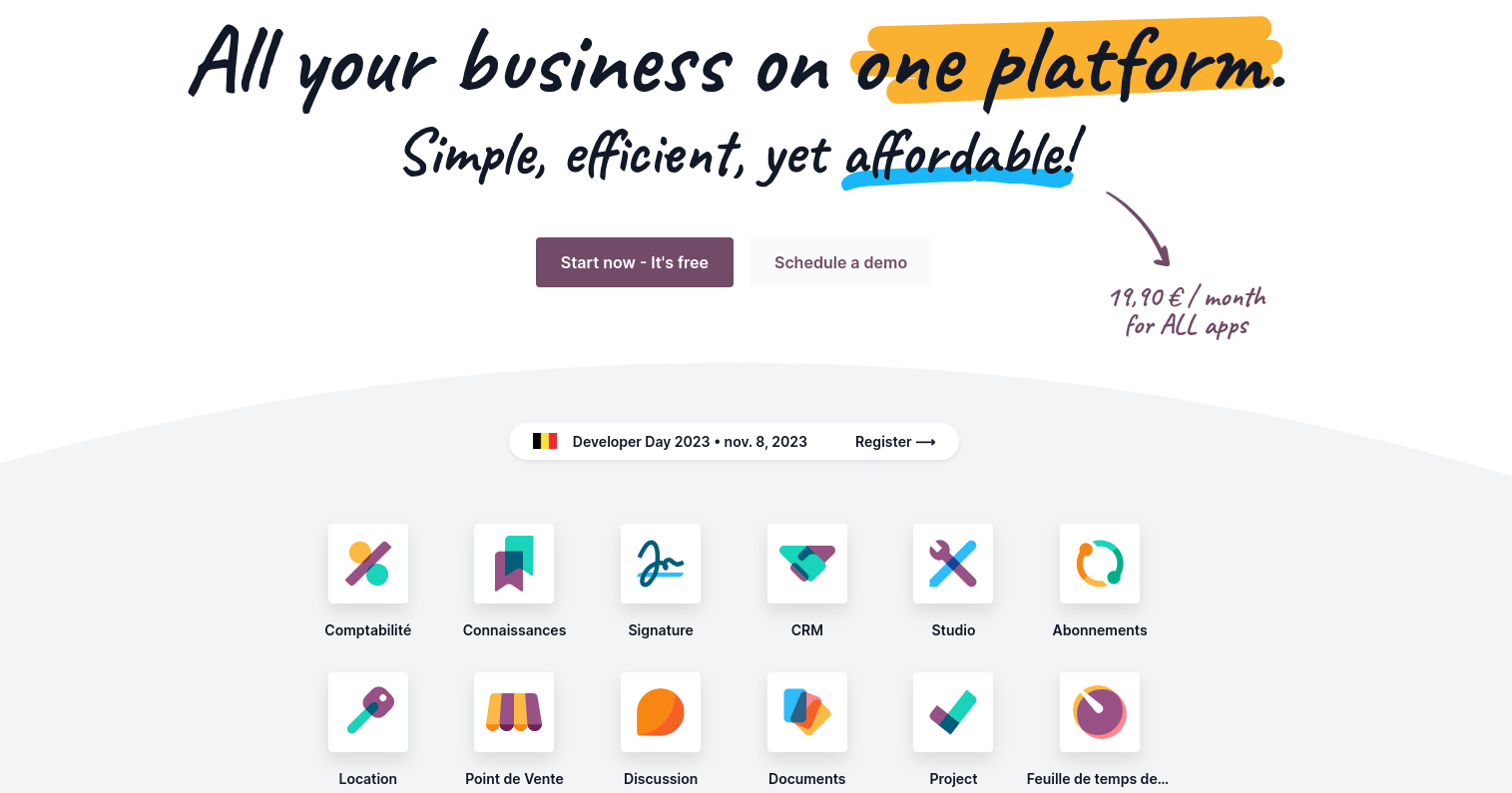

5. Odoo

Odoo is an open source ERP and CRM software originally developed by Odoo S.A. Odoo is a suite of web-based applications that cover many business needs such as accounting, inventory management, sales, CRM, project management, and more. Some key facts about Odoo include that it is open source, extremely customizable, includes modules for accounting, CRM, inventory management and many other business functions.

Pros: Some key advantages of Odoo include:

– It is open source which means it is free to download and use without a license fee.

– It is highly customizable through its module system and can be tailored to individual business needs.

– It offers one integrated solution for accounting, CRM, inventory, project management and many other business functions.

– It has a large global community and ecosystem of developers creating new apps and extensions.

– It offers both on-premise installation as well as a SaaS version through Odoo.com.

Cons: A potential disadvantage is that as open source software, support options are more limited compared to proprietary software. While community help forums exist, paid support options directly from Odoo S.A. may be required for production-level use.

Pricing: Odoo has the following pricing models:

– Free and open source version available for download and self-hosting.

– Odoo.com SaaS plans starting from $25-75/user/month depending on the number of users and modules selected.

– On-premise installation and implementation support packages also available directly from Odoo and partners.

Some key stats about Odoo include:

– Used by over 50,000 companies worldwide

– Available in over 70 different languages

– Has over 5 million downloads

– Has over 2,000 customizable modules available through its app store

6. Xero

Xero is an online accounting software for small businesses. Founded in 2006, Xero provides online accounting, invoicing and billing software with bank reconciliation, expense tracking and custom reports. With over 2.7 million subscribers worldwide, Xero aims to make business finances easy with beautiful and intuitive design.

Pros: Some key advantages of using Xero include:

– Beautiful and modern design that is easy to navigate

– Strong reporting capabilities with over 100 standard and customizable reports

– Easy setup process to import transactions and get started quickly

– Highly customizable chart of accounts, invoices, bank feeds and more

Cons: A potential disadvantage could be the subscription-based pricing model which requires monthly/annual payments compared to one-time purchase of other desktop accounting software.

Pricing: Xero offers three pricing tiers based on the number of active users:

– Solo – $9/month for up to 3 users

– Essentials – $30/month for up to 10 users

– Advanced – $70/month for unlimited users

All plans include unlimited transactions, invoices and bank reconciliation.

Some key stats about Xero include:

– Over 2.7 million subscribers worldwide

– Used by over 100,000 accountants globally

– Integrates with over 1,000 apps like QuickBooks, MYOB, PayPal, Salesforce etc.

– Winning accounting software according to numerous accolades and awards

7. FreshBooks

FreshBooks is accounting software for small businesses owned by FreshBooks, Inc. Founded in 2003 and headquartered in Toronto, Canada, FreshBooks offers services focused on invoicing, time tracking, expense management and online payments to help small business owners easily manage their finances. Their mission is to take the pain out of paperwork for solo entrepreneurs and small firms.

Pros: Some key advantages of FreshBooks include:

– Great for freelancers and contractors with built-in time tracking feature

– Intuitive invoicing tools that are easy to use to generate and send professional looking invoices

– Affordable pricing plans starting from $15 per month

– Mobile apps available for iOS and Android for invoicing and expense tracking on the go

Cons: A potential disadvantage is that the features are more basic compared to other full-fledged accounting software like QuickBooks. It may lack some advanced features needed by larger businesses.

Pricing: FreshBooks offers 3 pricing tiers:

– Solo – $15 per month billed annually

– FreshBooks for Teams – $25 per month billed annually

– FreshBooks for mid-size businesses – Custom pricing starting at $50 per month

Some key stats about FreshBooks:

– Over 24 million users worldwide

– Recipient of numerous awards including Best Bookkeeping Software and Best for Freelancers

– Integrates with over 150+ apps including QuickBooks, Xero and Shopify

– Accepts all major credit cards for payments through its online payment platform

8. Lightspeed POS

Lightspeed POS is a cloud-based point-of-sale and business management software. As a full-featured POS system, it provides retail, restaurant and golf course businesses with integrated payments, inventory, customer loyalty, reporting and more to help them run their operations.

Pros: Key advantages of Lightspeed POS include:

– Integrated retail POS system and inventory management solution

– Supports multiple store/location management from a single dashboard

– Intuitive design and interface optimized for both mobile and desktop

– Built-in loyalty programs, gift cards and customer profiles

– Advanced reporting and analytics on sales, inventory and customer behavior

Cons: A potential disadvantage is that the monthly subscription pricing may be higher than some lower-cost standalone POS systems. However, Lightspeed provides a more full-featured omnichannel solution.

Pricing: Lightspeed POS pricing starts at $49 per month for a basic retail plan, though customized plans are available based on business needs and features required. Additional payment processing fees also apply.

Some key stats about Lightspeed POS include:

– Used by over 80,000 customer locations worldwide

– Integrated payments solution that supports all major credit cards and alternative payment types

– Real-time inventory tracking across all sales channels

– Loyalty programs and custom CRM tools to increase customer retention

– Offers both basic and customized plans to suit businesses of all sizes

9. Infor CloudSuite Industrial

Infor CloudSuite Industrial is a comprehensive ERP solution specifically designed for industrial manufacturing companies. It offers a full range of financials, manufacturing, supply chain, and business intelligence capabilities preconfigured for industrial businesses. Infor CloudSuite Industrial streamlines operations from planning to production to shipping with built-in best practices for industrial manufacturers.

Pros: Main advantages of Infor CloudSuite Industrial include: – Comprehensive ERP for industrial manufacturers – Streamlines supply chain management processes from planning to execution. – Production planning, scheduling and costing tools optimize plant floor operations.

Cons: One potential disadvantage is that as a very full-featured ERP, it may have more capabilities than needed for some smaller manufacturers.

Pricing: Infor CloudSuite Industrial pricing is subscription-based starting at $150 per user per month for the essentials edition.

Some key stats about Infor CloudSuite Industrial include: – Over 15,000 customers globally across industrial manufacturing industries. – Implemented in the cloud with scalability and 99.9% uptime SLA. – Prebuilt industry templates reduce implementation time by up to 50%. – Integrated supply chain management and production planning tools.

10. Wave Apps

Wave Apps is a free accounting software solution designed specifically for small businesses. Founded in 2010 and based in Canada, Wave Apps aims to help small business owners save time and money with its comprehensive yet easy-to-use accounting platform.

Pros: Key advantages of Wave Apps include:

– Free basic accounting software with no monthly fees

– Simple setup that takes minutes not hours

– Cloud-based so you can access financials anywhere on any device

– Includes pre-built invoice templates to save time

– Integrated payroll and payment processing options

Cons: The main disadvantage is that advanced features like inventory management, projects, and reporting require an upgrade to one of their paid plans starting at $30/month.

Pricing: Wave Apps offers both free and paid plans. The free Basic plan supports up to 2 users, 3 projects, and 5 invoices sent per month. Paid Pro, Premium, and Bookkeeping plans range from $30-100/month and unlock additional features, user seats, reports, and accounting functionality.

Some key stats about Wave Apps include:

– Used by over 3 million businesses worldwide

– Available in over 30 languages

– Integrates with over 250 banking institutions

– Processes over $10 billion in payments annually

11. Zenefits

Zenefits is an all-in-one HR, benefits, and payroll platform for small businesses. Founded in 2013 and based in San Francisco, Zenefits offers a comprehensive software solution to help SMBs easily manage and scale their human resources needs. With over 4,000 customers, Zenefits is a leader in the HR tech industry.

Pros: Some key advantages of Zenefits include:

– All-in-one platform for HR, benefits, and payroll needs

– Robust compliance capabilities to help businesses stay up-to-date on regulations

– Integrated time tracking makes it easy to log hours and attendance

– Scalable pricing structure based on team size

Cons: One potential disadvantage is that the platform may have a steeper learning curve for SMBs used to handling HR administratively via spreadsheets. The software requires businesses to shift some processes online.

Pricing: Zenefits offers three pricing tiers based on team size:

– Solo: $9/mo for 1-3 employees

-Startup: $12/mo for 3-9 employees

-Scale: Custom pricing for 10+ employees including additional premium features

Some key stats about Zenefits include:

– Processes payroll for over 4,000 businesses

– Manages benefits enrollment and administration for over 1 million employees

– Integrates with over 200 benefit carriers and 50+ payroll providers

12. Harvest

Harvest is time tracking and accounting software designed for small businesses. Since its launch in 2006, Harvest has grown to help over 73,000 businesses streamline their workflows and stay on top of their finances. With Harvest, users can track time, manage projects and clients, generate customizable invoices, and gain insights through robust reporting – all in one simple tool.

Pros: Some key advantages of Harvest include:

– Attractive free plan available for basic time tracking and invoicing needs.

– Intuitive mobile apps that make it easy to track time from any device.

– Robust reporting features provide insights into how your time is spent.

– Flexible project and client management allows for easy organization.

– Data is securely stored in the cloud with automatic backups.

Cons: A potential disadvantage is that the paid plans may be too expensive for some very small businesses or freelancers just starting out. The free plan only allows for two active clients.

Pricing: Harvest offers three pricing tiers:

– Free Plan – Up to 2 active clients. $0/month.

– Plus Plan – Remove client limits. $12/user/month billed annually.

– Pro Plan – Add advanced features like task automation. $24/user/month billed annually.

Some key stats and features of Harvest include:

– Has been in business since 2006 and serves over 73,000 customers worldwide.

– Offers both free and paid subscription plans to suit businesses of all sizes.

– Has apps available for iOS and Android to allow time tracking and invoicing on the go.

– Lets you easily track time against projects, clients, and tasks for accurate billing.

– Customizable invoicing that can be branded and paid throughHarvest or manually.

13. GnuCash

GnuCash is a free and open source accounting software for personal and small business use. Developed by the GnuCash non-profit organization, it has been in active development since 1997 and now supports Windows, Mac, GNU/Linux and other operating systems. With GnuCash, you can track bank accounts, stocks, income and expenses. It uses double-entry accounting which ensures balance sheet always balances out.

Pros: Some key advantages of GnuCash include:

– Free and open source software with no subscription fees

– Fully-featured accounting functionality yet easy to learn

– Offline desktop experience with robust reporting

– Double-entry accounting ensures accuracy of financial records

– Extensive support through documentation and online community

Cons: One potential disadvantage is that as a desktop application, it does not offer online or mobile access to financial data like some paid accounting software options.

Pricing: GnuCash is completely free to download and use with no limits. There are no subscription or licensing fees. The software is funded through donations from users.

Some key stats about GnuCash include:

– Available in over 30 languages

– Used by over 1 million users worldwide

– Free to download and use for any purpose

– Follows industry standard double-entry accounting

– Cross-platform support for Windows, Mac and Linux

14. Vend

Vend, now known as Lightspeed, is a cloud-based POS and inventory management software designed to help retailers improve operations and sales. Founded in 2005, Vend has grown to support over 45,000 customers globally across 150 countries. With features like optimized POS, inventory tracking, and built-in payments and loyalty programs, Vend aims to give retailers everything they need to manage their business across physical and digital sales channels.

Pros: The main advantages of Vend include:

– Optimized storefront POS tailored for in-person retail transactions

– Robust inventory management with barcode scanning for easier tracking

– Built-in payment processing to accept all major credit cards and alternatives

– Loyalty programs to reward repeat customers and drive sales

– Integrated warehousing and inventory tools for omnichannel fulfillment

Cons: One potential disadvantage is that as a cloud-based solution, Vend requires an internet connection to access all features from any location. This could pose issues if the internet goes down for an extended period.

Pricing: Vend offers various pricing tiers depending on needs. Basic plans start at $79 per month for a single user store. Premium and enterprise plans with additional features are priced upwards from there. Vend also offers a free 30-day trial to test out the software without commitment.

Some key stats about Vend include:

– Supports over 45,000 customers globally across 150 countries

– Provides optimized POS for inventory-based retailers

– Allows tracking of inventory with barcode scanning

– Offers multiple payment options directly in the software

– Includes built-in loyalty programs to engage customers

15. TaxAct Business

TaxAct Business is an accounting software option for small businesses developed by TaxAct, an online tax filing company. TaxAct Business provides tools for payroll, invoicing, expenses, and more to help small businesses manage their finances.

Pros: Key advantages of TaxAct Business include its robust payroll and tax filing features to handle all employee payroll taxes. It also offers the ability to partner with CPAs through TaxAct for additional guidance. Users can import and export data seamlessly with QuickBooks. Pricing is reasonably affordable for small businesses.

Cons: One potential disadvantage is that the small business accounting functionality may not be as fully-featured as dedicated small business accounting software like QuickBooks. The user interface could also feel a bit basic for some users accustomed to more robust accounting software UIs.

Pricing: TaxAct Business pricing starts at $24.95 per month for the Basic subscription, which allows for unlimited invoices, expenses and time tracking. The Premier subscription is $49.95 per month and adds payroll functionality. Both plans have a free 30-day trial available.

Some key stats about TaxAct Business include: it serves over 1 million small businesses; integration with QuickBooks for easy data import/export; partnerships available with CPAs and tax professionals for additional support; and robust payroll functionality to handle all payroll tax filings.

Conclusion

Choosing the right accounting software is an important decision for any small business. This evaluation of the top 15 platforms considered key factors to help you make the best choice based on your unique business needs, budget and goals for the new year. All of the options reviewed offer robust functionality for accounting and financial management. The top picks combined comprehensive features with affordable pricing, intuitive interfaces and excellent support. With the right software, you can spend less time on manual administrative tasks and more time growing your business.