Introduction

Choosing a brokerage trading platform is an important decision for both new and experienced investors. The right platform can help you execute trades efficiently, analyze markets and companies, and develop successful investing strategies. However, with so many options available today it’s not always easy to determine the best fit. This guide reviews 15 of the most popular brokerage trading platforms, evaluating each based on features, costs, and quality to identify the top offerings for a variety of needs.

Methods of Evaluation

To evaluate and rank each platform, several key criteria will be considered: tools and resources available, research/educational materials, platform usability and customization, fees, and popularity signals like traffic, reviews and number of backlinks. Additional considerations may include specialized capabilities for certain investors like options/futures traders. Platforms will be compared side by side and an overall ranking determined based on balancing these various factors.

1. Yahoo Finance

Yahoo Finance is a free financial data tracking and investing platform from Yahoo. With Yahoo Finance, users can access free stock quotes, market data, portfolio tracking and basic research tools for making investment decisions.

Pros: Some key advantages of using Yahoo Finance include:

– Free basic charting, screeners and portfolio tracker.

– Wide range of real-time news and company financial data and metrics.

– Good starting point for beginner investors to do basic research and tracking.

Cons: The main disadvantage of Yahoo Finance is that it only offers basic tools and features. More advanced functionality like analytics, options trading or futures is not available on the free platform.

Pricing: Yahoo Finance offers all of its core features for free. There are no subscription plans or fees required to use the basic functionality of stock screening, tracking, news and research.

Some key stats about Yahoo Finance include:

– Over 100 million monthly active users globally accessing financial data and tools.

– Real-time stock prices and market data for over 30,000 securities globally.

– Free stock screening and watchlist functionality to track investments.

2. Merrill Edge

Merrill Edge is the online and mobile investing service offered through Bank of America’s Merrill brokerage unit. With Merrill Edge, investors can take advantage of Bank of America’s backing and reputation as one of the largest financial institutions in the world. The platform offers robust investment tools and research to help both casual and experienced traders build portfolios.

Pros: Some key advantages of using Merrill Edge include:

– Backed by a well-regarded brokerage firm with decades of experience

– Robust suite of investment research, models and guidance from Merrill analysts

– Access to financial advisors through Merrill if help is needed building a portfolio

Cons: One potential disadvantage is that Merrill Edge may attract more casual traders rather than powerful tools needed by active day traders due to its focus on long-term investing.

Pricing: Merrill Edge offers several pricing tiers for online trading including $0 online trades for U.S. exchange-listed stocks and ETFs. Pricing ranges from $0 per trade up to $6.95 per online equity or ETF trade depending on the account tier and activity levels.

Some key stats about Merrill Edge include:

– Over $2.6 trillion in total client balances across Merrill Lynch platforms

– Access to over 13,000 financial advisors through Merrill Lynch

– More than $800 billion in deposits and investment assets for Bank of America overall

3. TradingView

TradingView is a popular charting platform and social network for traders. Founded in 2011, the site allows traders to view live price charts for stocks, commodities, indices and cryptocurrencies. Traders can also connect their brokerage accounts to TradingView for live trading directly from the platform’s charts.

Pros: Some key advantages of TradingView include:

– Free yet very powerful charting and ideas platform

– Advanced technical indicators and drawing tools

– Connects to brokers for simulated and live trading

– Huge community of analysts sharing signals

Cons: One potential disadvantage is that the free version has some limitations on functionality compared to the paid tiers. Advanced tools like automated trading signals and alerts require a paid subscription.

Pricing: TradingView offers both free and paid subscription plans. The free plan provides access to basic charts and technical analysis tools. Premium plans starting at $9/month unlock more indicators, alerts, and greater chart customization options.

TradingView boasts over 15 million users worldwide. The platform supports over 50 exchanges and provides charts with over 500 technical indicators. TradingView is also home to a large community of analysts who share trading ideas and signals on the site.

4. Charles Schwab

Charles Schwab is one of the largest brokerage firms and providers of financial services for individual investors. Founded in 1971 and headquartered in San Francisco, California, Schwab manages over $6 trillion in client assets as of 2022. Some key facts about Charles Schwab include that it serves over 30 million brokerage and banking accounts with over 3,000 financial consultants in offices globally.

Pros: Some key advantages of using Charles Schwab as your brokerage include commission-free US stock and ETF trading, robust research and analysis tools, educational resources for novice traders to learn more about investing and trading, and integrated web and mobile platforms for seamless trading on the go.

Cons: One potential disadvantage of Charles Schwab is that some of the more advanced traders may find the research and analysis tools not as powerful compared to other dedicated investing platforms. The app and web interfaces also do not offer the same level of customization as specialized trading software.

Pricing: For individual investors, Charles Schwab does not charge commissions for online trades of US-listed stocks and ETFs. For mutual funds, there are no transaction fees on Schwab ETFs and no-load mutual funds. Margin interest rates start at 4.25% for buying on margin.

Key stats about Charles Schwab include that it has over $6 trillion in client assets, serves over 30 million brokerage and banking accounts, offers commission-free trading on US stocks and ETFs, and provides over 500 mutual funds with no transaction fees.

5. SaxoTraderPRO

SaxoTraderPRO is Saxo Bank’s flagship online trading platform. As a fully-integrated, next generation trading platform, SaxoTraderPRO empowers both beginner and experienced traders to invest across global financial markets with access to over 30,000 tradable instruments including forex, CFDs, futures, options and bonds.

Pros: Some key advantages of SaxoTraderPRO include:

– Robust platform for trading stocks, ETFs, forex, futures and more globally

– Excellent research tools include news, fundamental and technical analysis

– Wide range of charting tools and indicators for technical analysis

– Customizable layout and workspace for optimal workflows

– Powerful alert functions to automate trading strategies

– Educational resources such as webinars, e-books and videos for all experience levels

Cons: One potential disadvantage of SaxoTraderPRO is that it requires an investment to access as pricing is based on market activity. It may therefore be more suitable for active traders versus passive investors.

Pricing: SaxoTraderPRO pricing is based on trading activity and volume on the platform. There are several packages available starting from the Personal package which has a minimum monthly fee of $10 or 10 EUR. Packages thereafter have tiered pricing based on the number of trades, lots traded and portfolio value.

Some key stats about SaxoTraderPRO include:

– Available in 15 languages

– Used by over 150,000 traders globally

– Provides access to more than 70 exchanges and more than 30,000 financial instruments

– Supports desktop, web and mobile platforms for consistent and connected trading experiences

6. ThinkOrSwim

ThinkOrSwim is a powerful yet user-friendly trading platform developed by TD Ameritrade. It offers an integrated suite of tools for online stock trading, investing and technical analysis. With ThinkOrSwim, traders can paper trade using the PaperMoney mode to practice strategies without risking real money. Its sophisticated yet intuitive design allows both beginner and experienced traders to analyze markets and place trades.

Pros: Some key advantages of ThinkOrSwim include:

– Sophisticated and powerful yet user-friendly interface for traders of all levels.

– Great charting, scanning and technical analysis tools for researching markets and finding trading opportunities.

– PaperMoney mode allows practicing trading strategies on a virtual balance without risking real money.

– Integrated directly with the TD Ameritrade brokerage for fast, reliable trade execution.

Cons: One potential disadvantage is that as a more full-featured platform, it does have a steeper learning curve compared to simpler brokerage platforms. Beginner traders may find it more complex to learn initially.

Pricing: ThinkOrSwim is free to use as it is provided by TD Ameritrade. They do not charge any platform or data fees. Traders only pay the standard commission fees per trade which vary based on trade type and volume.

Some key stats and facts about ThinkOrSwim include:

– Over 6 million accounts and $4 trillion in annual client trades.

– Available as desktop platform for Windows and Mac as well as mobile apps for iOS and Android.

– Powerful charting platform with over 50 technical indicators and studies.

– Real-time market scanner to search for stocks based on technical criteria.

– Integrated directly with TD Ameritrade brokerage for fast trade execution.

7. Merrill Edge

Merrill Edge is the online and retail brokerage platform of Bank of America subsidiary Merrill Lynch. Merrill Edge provides online trading across major US exchanges along with investment guidance and research. Clients have access to a suite of Bank of America banking services when using Merrill Edge.

Pros: Key advantages of using Merrill Edge include:

– Full-service online trading platform for investing without commissions

– Backed by Merrill Lynch’s investment guidance and research capabilities

– Ability to access Bank of America’s branch network and banking products

– Smooth integration and account management between Merrill and Bank of America accounts

Cons: A potential disadvantage is that Merrill Edge has higher account minimums than some online-only competitors. Standard brokerage accounts require a $25,000 minimum.

Pricing: Merrill Edge offers commission-free online trading across major exchanges. There are no fees to open or maintain standard brokerage accounts, however accounts below $25,000 are subject to an inactivity fee.

Some key stats and offerings of Merrill Edge include:

– Over $2.7 trillion in client balances

– Access to over 13,000 financial advisors

– Free online trading of stocks, ETFs, options and fixed income

– Robust research platform from Merrill analysts and strategists

8. Acorns

Acorns is an investing app that helps users automatically invest their spare change from everyday purchases into ETFs for long-term growth. Through micro-investing from spare change and rounding up purchases to the nearest dollar amount, Acorns makes it easy for anyone to start investing with any amount of money. With over 6 million users, it’s one of the most popular investing apps for beginners.

Pros: Some key advantages of using Acorns include:

– Passive long-term automated investing through its round-ups and autosave features.

– Micro-investing allows investing spare change from everyday purchases.

– Simple and intuitive user experience makes it great for beginner investors.

– Extensive educational resources through articles and videos to help users learn about investing.

Cons: A potential disadvantage is that Acorns has higher fees compared to other traditional brokerages since it is targeting beginner investors. The annual fee is 0.25% of your balance and $1 per month if your balance is under $5,000.

Pricing: Acorns offers 3 plans:

– Found Money (free): Basic micro-investing features through round-ups and autosave.

– Later (from $1/month): Adds retirement accounts and tools.

– Acorns Complete ($3/month): Adds stock trading through Acorns Brokerage and up to 5 extra ETFs in your portfolio.

Some key stats about Acorns include:

– Over $6 billion in assets under management from its user base.

– Allows investments starting from as little as $5 with no minimum balance required.

– Offers 5 portfolio options ranging from conservative to aggressive based on risk tolerance.

9. Betterment

Betterment is an online financial advisor focusing on robo-advisory services. Founded in 2008, Betterment utilizes algorithms and goal-based portfolio adjustments to help individuals achieve their financial goals. With over $27 billion in assets under management, Betterment is one of the largest robo-advisors on the market.

Pros: Some key advantages of using Betterment include:

– Robo advisory for goals-based investing – Betterment builds portfolios customized to your goals and risk tolerance.

– Automated personalized portfolios – Portfolios are automatically adjusted based on your goals and market conditions.

– Commission-free ETFs – Trade ETFs without trading fees or fund minimums.

– Great educational tools – Educational resources help users learn about investing and financial planning.

Cons: One potential disadvantage is the lack of personalized attention. While Betterment offers robo-advice, users do not have access to a dedicated financial advisor and must manage their accounts through the online platform.

Pricing: Betterment offers two pricing tiers: Betterment Digital (0.25% annual fee) and Betterment Premium (0.40% annual fee). There are no account minimums, trading fees, or commission costs with Betterment.

Some key stats about Betterment include:

– Over 1 million users

– $27 billion in assets under management

– Commission-free trading of ETFs

– Tax-smart portfolio adjustments

– Goals-based investment options for retirement, home purchases, education savings, and more

10. Wealthsimple

Wealthsimple is a Canadian financial technology company offering automated investment management and commission-free trading. Founded in 2014, Wealthsimple uses low-cost exchange-traded funds (ETFs) to build globally diversified portfolios for customers. They aim to make investing simple and affordable for everyone.

Pros: Some key advantages of using Wealthsimple include:

– Automated globally diversified ETF portfolios without the effort of rebalancing

– Very low overall fees compared to traditional brokerages and robo-advisors

– Allows purchasing fractional shares, great for small account sizes

– Excellent option for hands-off passive investors wanting broad market exposure

Cons: A potential disadvantage is that investing options are limited to ETFs only with no access to individual stocks or bonds. Customization of portfolios is also not as robust as some competitor platforms.

Pricing: Wealthsimple offers three main plans:

– Wealthsimple Invest (Passive investing): 0.5% management fee per year

– Wealthsimple Trade (Commission-free stock trading): No trading fees

– Wealthsimple Cash (High-interest savings account): 1.25% interest rate

Some key stats about Wealthsimple include:

– Over $12 billion in total assets under management

– Over 500,000 clients in Canada

– Commission-free stock and ETF trading

– Fractional share investing from $1 minimums

– Portfolio management fees as low as 0.5%

11. Wealthfront

Wealthfront is a robo-advisor that provides automated portfolio management and financial planning tools to help investors grow their wealth over time. Founded in 2008, Wealthfront has grown to manage over $25 billion in assets for hundreds of thousands of clients. The company offers commission-free automated investing, tax-loss harvesting, and other strategies to help lower costs and maximize returns for investors.

Pros: Some key advantages of using Wealthfront include:

– Very low fees of just 0.25% per year

– Tax-efficient portfolio management using automated tax-loss harvesting

– Free access to financial planning tools like retirement calculators and education savings calculators

Cons: A potential disadvantage is that Wealthfront has more limited customization options compared to some robo-advisors. Investors have less control over choosing individual stocks and bonds for their portfolio.

Pricing: Wealthfront offers three pricing tiers:

– Cash Account: Free and has no account minimum. Earns 0.30% APY.

– Investment Account: 0.25% per year on assets under management. $500 minimum deposit.

– Platinum Account: Adds additional services like financial planning for 0.40% per year on all assets.

Key stats about Wealthfront include:

– Over $25 billion in total assets under management

– Hundreds of thousands of clients

– Commission-free trading

– Target annual return of 5% after fees

12. Personal Capital

Personal Capital is a personal finance software and wealth management firm that offers powerful tools and services to help users track their net worth, investments, retirement and budget. Founded in 2009 and headquartered in Silicon Valley, it has established itself as one of the leading platforms for managing finances.

Pros: Some of the key advantages of Personal Capital include:

– Leading tools for net worth tracking and analysis with powerful aggregation capabilities

– Robo advisory services bundled with brokerage and retirement accounts for automated investing

– Powerful financial planning calculators and tools to model scenarios for retirement, mortgages etc.

– Experienced advisors available to answer questions and provide guidance

Cons: The main disadvantage is the minimum account balance requirement of $25,000 to access robo advisory services. This rules out the platform for many individuals just starting to save and invest.

Pricing: Personal Capital offers both free and paid service tiers. The basic investment tracking and analysis tools are available for free. For its robo advisory services, it charges an ongoing advisory fee of 0.89% of assets per year on balances over $25,000.

Some key stats about Personal Capital include:

– Serves over 3 million users

– Manages over $120 billion in total client assets

– Offers robo advisory services with minimum account balances starting from $25,000

– Provides financial plans and retirement projections

– Features advanced portfolio analysis and investment screening

13. TradeStation

TradeStation is a full-service online brokerage firm that provides trading platforms and tools to trade stocks, ETFs, options, futures and forex. Founded in 1982, the company has grown to serve over 175,000 active funded accounts.

Pros: Some of the key advantages of TradeStation include its easy to learn and use interface, wide variety of charting and technical analysis tools, strong offerings for futures and options trading, ability to customize market scans and screeners, robust paper trading feature and educational resources.

Cons: One potential disadvantage is that TradeStation’s platforms are best suited for more experienced traders and investors due to the depth of tools and functionality. The learning curve may be steeper for beginners.

Pricing: TradeStation offers several pricing tiers starting from $9.99 per month for a basic account up to institutional level pricing. Margins and commissions are competitive across all asset classes. Educational materials are also priced affordably to aid in learning and mastery of using the platforms.

Some key stats about TradeStation include: Over 175,000 funded accounts, supports trading in over 10,000 securities, award-winning charting and analysis tools, variety of platforms from basic to advanced, access to futures, forex and crypto trading.

14. MetaTrader 4

MetaTrader 4 (MT4) is a free-of-charge Forex trading platform developed by MetaQuotes Software and available for desktop and mobile devices. Launched in 2005, it is one of the most popular and widely used Forex trading platforms globally with over 300 Forex brokers currently supporting it.

Pros: Some key advantages of MetaTrader 4 include:

– Free and widely available platform globally

– Advanced charting features and over 50 technical indicators for in-depth technical analysis

– Ability to automate trading through ‘Expert Advisors’ and algorithmic trading strategies

– Supports Crypto and CFD trading in addition to Forex

Cons: One potential disadvantage of MetaTrader 4 is that as a free platform, basic customer support is also free which can sometimes lead to slower response times compared to premium brokers.

Pricing: MetaTrader 4 is available free of charge from MetaQuotes directly or through brokers supporting the platform. There are no subscription or license fees required to use the platform.

Some key stats about MetaTrader 4 include:

– Used by over 15 million traders worldwide

– Available in 35+ languages

– Over 300 Forex brokers currently support MT4

– Flexible architecture allows for customization through automated and expert advisors

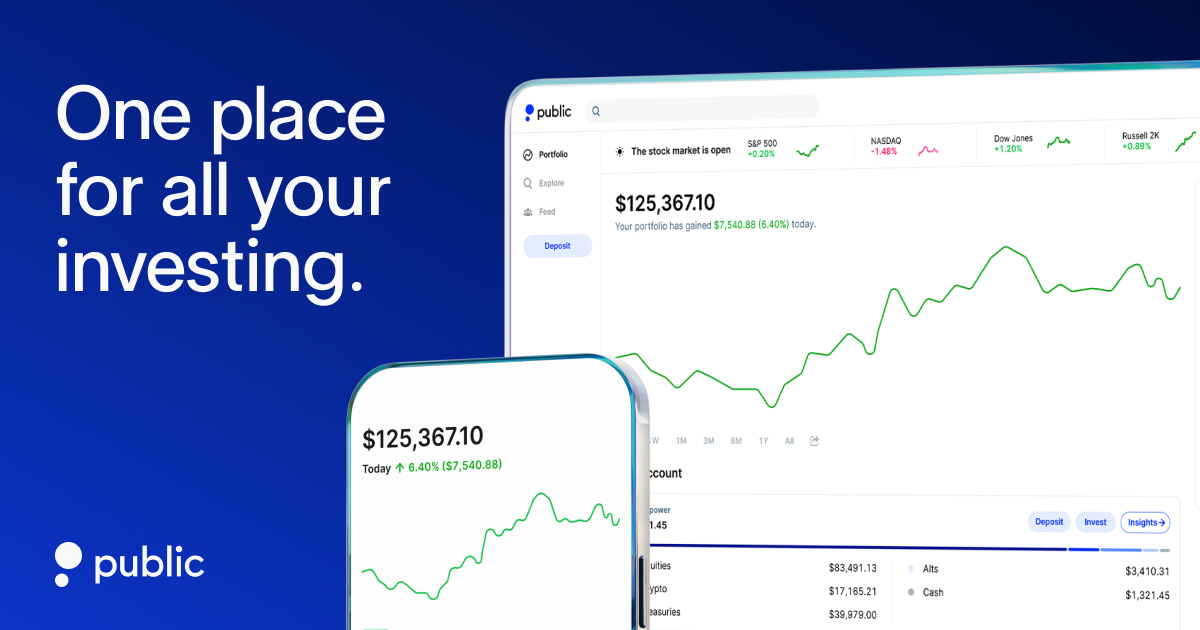

15. Public.com

Public.com is a commission-free investing app that allows users to invest in stocks, treasuries, crypto, ETFs, and alternative assets. Founded in 2018, Public.com has over 6 million users and emphasizes community discussion and access to exclusive IPOs at times. Public.com offers a unique investing experience through its social features and focus on long-term, socially responsible investing.

Pros: Some key advantages of Public.com include:

– No trading commissions makes it very cost effective for regular investing

– Strong social features allow users to discuss stocks and get investing ideas

– Focus on long-term, sustainable investing appeals to socially conscious investors

– Occasional exclusive access to buzzy IPOs can offer good investment opportunities

Cons: One potential disadvantage is Public.com has fewer advanced trading tools than some other brokerages, making it best suited for regular, buy-and-hold investing rather than very active trading.

Pricing: Public.com has a very simple pricing model – there are no trading commissions or per trade fees. The platform is entirely free to use for regular stock, ETF and crypto investing.

Some key stats about Public.com include:

– Over 6 million users

– Commission-free investing in stocks, ETFs, crypto and more

– Emphasis on community discussions around investing

– Occasionally offers exclusive access to hot IPOs

Conclusion

With the variety of brokerage platforms available today, there is no single best option. Investors must evaluate their individual needs and trading style to find the right fit. This review seeks to shed light on the capabilities and strengths of some of the most widely used platforms. By understanding how each platform stacks up based on features, costs and popularity indicators, investors can make a more informed choice to enhance their odds of trading and investing success.