Introduction

Accounting software is a must-have tool for any small business to efficiently manage finances and invoices. With the popularity of Mac computers among entrepreneurial users, it’s important to identify high-quality accounting apps that are compatible with the Mac operating system. This guide reviews 15 of the top accounting software solutions for Mac in 2023 based on their functionalities, pricing, and user experience. We also outline our method for evaluating and ranking each software.

Methods of Evaluation

To evaluate and rank the accounting software solutions, we considered various factors like pricing and features, but also leveraged metrics like number of backlinks, traffic, and keyword trend data to ensure the most popular and established platforms rank higher. Specifically, we looked at features like invoicing, payroll, expense management, reporting, integrations, and ease of use. We also analyzed pricing options, reviews from professionals, and online discussion forums to understand the general user sentiment for each software.

1. QuickBooks

QuickBooks is an accounting software developed and marketed by Intuit. With over 100 million users worldwide, QuickBooks is one of the most popular accounting software for small businesses. It provides an intuitive interface for tracking finances, managing invoices and tracking expenses.

Pros: Some key advantages of QuickBooks include:

– Intuitive interface for efficiently tracking finances

– Strong reporting features to monitor cash flow and business performance

– Integrates seamlessly with bank accounts to sync transactions

– Supports invoicing, expenses and time tracking

Cons: One potential disadvantage is that QuickBooks does not currently offer a native app for Mac. Users need to access it via the web browser.

Pricing: QuickBooks pricing starts from $20 per month for the self-employed plan and goes up to $100 per month for the highest tier Premier plan. Discounts are available if one signs up for an annual subscription.

Some key stats about QuickBooks include:

– Used by over 7 million small businesses worldwide

– Integrates with over 6,000 banks and credit card providers

– Generates over 120 billion in invoices annually

2. Xero

Xero is an online accounting software that connects users to their bank, accountant, bookkeeper and other business apps. As cloud-based software, Xero can be accessed from any device with an internet connection, making it very convenient for mobile and remote work. It offers core accounting features along with payroll capabilities to help small businesses and their advisors get paid, get paid on time and understand their cash flow.

Pros: Key advantages of Xero accounting software include:

– Cloud-based for easy access from any device

– Built-in payroll features

– Excellent support and community

– Integrates banking transactions automatically

– Real-time business insights with automated reports

Cons: A potential disadvantage is that the paid plans can be more expensive for larger businesses with higher monthly transaction volumes. The free starter plan also has limited capabilities.

Pricing: Xero offers several pricing plans starting from a free Starter plan for sole traders up to a Custom plan for larger businesses. Standard pricing starts at $30 per month for up to 3 users with additional users available at $10 per user.

Some key stats about Xero include:

– Used by more than 2 million subscribers globally

– Integrates with over 800 third party applications

– Supports multi-currency accounting

– Available in over 180 countries

3. BambooHR

BambooHR is a leading HR software provider based in Lindon, Utah. Founded in 2008, BambooHR provides a full-featured cloud-based HR platform to help organizations simplify HR processes. With over 25,000 customers worldwide, BambooHR serves small and medium-sized businesses across various industries.

Pros: Some key advantages of BambooHR include: – Full-featured HR platform to handle all HR needs from hiring to retiring. – Intuitive onboarding, benefits administration, and performance review features. – Integrates seamlessly with major payroll providers for streamlined payroll processing.

Cons: A potential disadvantage is that the premium pricing tiers may be costly for some very small businesses.

Pricing: BambooHR offers three pricing tiers – Essentials ($5/employee/month), Select ($8.50/employee/month), and Ultimate ($12/employee/month). Add-ons like background checks, onboarding packages, and e-signatures are available for additional fees.

Some key stats about BambooHR include: – Supports over 25,000 customers globally. – Integrates with over 150+ payroll and benefits providers such as Automatic Payroll, Gusto, TriNet, and Paychex. – Processes $9B+ in annual payroll for customers. – Features onboarding and offboarding workflows, performance reviews, benefits administration, and HR compliance features.

4. FreshBooks

FreshBooks is cloud-based accounting software designed for freelancers and small businesses. Since 2004, FreshBooks has been helping small businesses manage invoices, track time, organize receipts, and accept payments. With over 30,000 reviews on TrustPilot, it is consistently rated as one of the best accounting software options for Mac.

Pros: Some key advantages of FreshBooks include:

– Simple to use yet powerful invoicing and billing tools

– Intuitive time tracking to easily log billable hours

– Integrates with popular business apps for seamless workflow

– Excellent customer support included at all pricing levels

– Good for both freelancers as well as small agencies and businesses

Cons: A potential disadvantage is the pricing, as it only offers basic accounting features on the starter plan. For more advanced features like expense categorization, you need to upgrade to a paid plan starting at $15/month.

Pricing: FreshBooks offers 3 pricing tiers:

– Free forever plan – Suitable for up to 3 clients with basic invoicing

– ‘FreshBooks’ plan – Starts at $15/month billed annually with advanced features

– ‘FreshBooks Plus’ plan – Starts at $25/month billed annually with additional customization

Some key stats about FreshBooks include:

– Used by over 20 million users worldwide

– Manages over $30 billion in transactions annually

– Offers full functionality on a free forever plan for up to 3 clients

– Integrates with over 150+ business apps including Dropbox, Slack, Xero and QuickBooks

5. Wave

Wave is a free small business accounting software that offers robust features even for the free basic account. With over 15 years of experience, Wave has become one of the top accounting software options for small businesses and freelancers looking for an affordable solution.

Pros: Some key advantages of using Wave accounting software include:

– Free basic account with robust features like invoicing, expenses, reports, etc.

– Built-in receipt scanning allows expenses to be easily tracked by uploading photos of receipts

– Clean, intuitive dashboard makes accounting simple and easy to manage

Cons: The main disadvantage is that additional paid plans are required for advanced features like multiple user logins, advanced reporting, and integration with other apps. However, the free basic plan covers many core accounting needs.

Pricing: Wave offers three pricing tiers:

– Free Basic – Free forever

– Plus – $15/month billed annually

– Premium – $30/month billed annually

The free basic plan covers invoicing, expenses, time tracking, and more for 1 user. Paid plans unlock additional features and support.

Some key stats and facts about Wave accounting software include:

– Used by over 30 million people worldwide

– Built-in credit card processing and payroll services available

– Receipts can be scanned directly into the app for easy expense tracking

6. Avalara AvaTax

Avalara AvaTax is a leading sales and VAT/GST tax calculation and compliance cloud software. It has helped thousands of businesses automate and streamline their tax processes. AvaTax determines the correct tax for any transaction in over 10,000 taxing jurisdictions, including all US states, Canadian provinces, and EU countries.

Pros: Key advantages of Avalara AvaTax include: – Sales tax calculation integrated directly into core business systems to simplify compliance. – Receipt imaging capabilities to archive all purchase receipts for tax deductions. – Integrations with popular accounting tools like QuickBooks and Xero for seamless workflow.

Cons: One potential disadvantage is the cost as it is an enterprise-level software which may not suit very small businesses with low transaction volumes.

Pricing: Avalara AvaTax pricing starts from $49 per month for the basic plan suitable for smaller businesses and goes up based on the number of tax rates, jurisdictions, users and other advanced features required. Enterprise packages are customized based on business needs and volume of transactions.

Some key stats about Avalara AvaTax include: – Calculates taxes in over 10,000 jurisdictions worldwide. – Integrates with over 300 ERP, ecommerce, and accounting systems including QuickBooks, Xero, Shopify etc. – Handles over $500 billion in transactions annually. – Used by over 10,000 customers globally including large enterprises and SMBs.

7. Harvest

Harvest is a time tracking and project management software that helps freelancers and agencies track time, create invoices, and get paid faster. Founded in 2006 and based in Montreal, Harvest has grown to serve over 73,000 businesses worldwide. Their software provides an easy way to track time, monitor billable hours, generate professional invoices, and get paid.

Pros: Some key advantages of Harvest include:

– Simple and intuitive interface makes time tracking a breeze for teams.

– Automatic invoice generation directly from tracked time saves time on billing.

– Detailed reporting on billable hours, productivity, and more gives insights to optimize business.

– Integrations with popular apps like QuickBooks streamline the invoice-to-payment process.

Cons: One potential disadvantage is that Harvest is mainly focused on time tracking rather than full project management features like Gantt charts, task assignments, file sharing etc. So it may not be the best fit for complex project management needs.

Pricing: Harvest offers 3 pricing tiers:

– Free plan for up to 2 users with limited features.

– Plus plan starts at $12/user/month billed annually which unlocks all core features.

– Enterprise plans for larger teams with customized features and pricing.

Some key stats about Harvest include:

– Over 73,000 businesses worldwide use Harvest for time tracking and invoicing.

– Users can track time for an unlimited number of clients and projects.

– Harvest integrates with over 200 apps including QuickBooks, Xero, and Wave to simplify finances.

– Mobile apps available for both iOS and Android to track time on the go.

8. GnuCash

GnuCash is an open source personal and small business finance system that is cross-platform, meaning it can be used on Mac, Windows and Linux operating systems. It aims to be easy to use, yet powerful and flexible. Development of GnuCash began in 1998 and continues to be actively maintained by volunteer developers.

Pros: Some key advantages of using GnuCash include: – Free and open source nature means no licensing costs – Robust feature set for tracking income, expenses, assets, liabilities and net worth – Cross-platform usability allows it to be used on Mac, Windows or Linux systems interchangably

Cons: As an open source product developed by volunteers, GnuCash may lack some features of proprietary accounting software. Customer support is also primarily via online forums rather than a dedicated support team.

Pricing: GnuCash is completely free to download and use. There are no licensing or subscription fees associated with its use.

Some key stats about GnuCash include: – Available for free download on macOS, Windows and Linux platforms – Supports multiple currencies and languages – Over 2 million downloads to date – Actively developed by a global community of volunteers

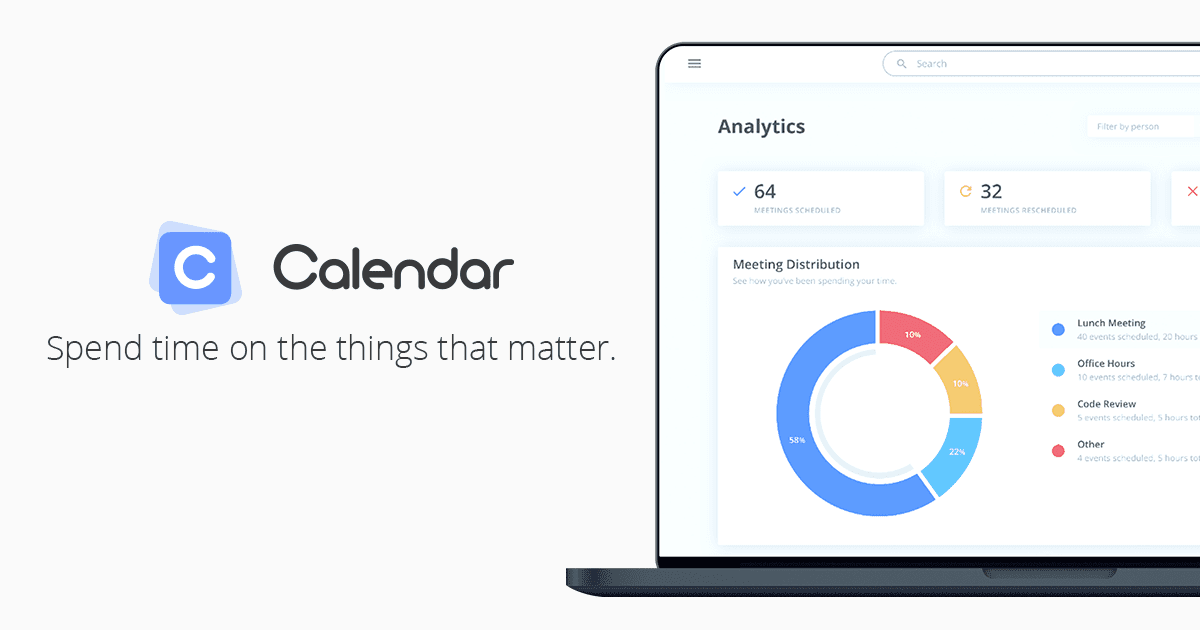

9. Calendar

Calendar is an online calendar and team scheduling software that helps users manage their schedules and book meetings. It provides an all-in-one team calendar for scheduling shared resources, managing team and client calendars, and logging time and tasks.

Pros: Some key advantages of Calendar include:

– Time tracking software for logging billable and non-billable hours

– Built-in time sheets to generate invoices from logged time

– Invoicing and recurring billing capabilities to streamline client projects

Cons: One potential disadvantage is that Calendar is primarily a web and mobile app, so it may not have as robust desktop functionality as other accounting software designed specifically for desktop.

Pricing: Calendar offers various pricing tiers starting from a free Basic plan for up to 3 users. Paid Professional and Enterprise plans start at $10/user/month billed annually with additional features for larger teams.

Some key stats about Calendar include:

– Used by over 50,000 teams worldwide

– Integrates with services like Gmail, Outlook, and Slack

– Allows unlimited public and private calendars to be created

10. TaxAct Business

TaxAct Business is an affordable accounting software designed for small businesses. It covers the basics of invoicing, billing, expenses, and payroll needs. Some key features include the ability to create and send professional invoices, track time and expenses, manage accounts receivable and payable, and more.

Pros: Key advantages of TaxAct Business include:

– Integrations with QuickBooks and Xero for easy data transfer

– Affordable pricing for basic accounting and invoicing workflows

– Easy to use interface designed for small businesses and self-employed individuals

Cons: A potential disadvantage is that the software may not have as many features as higher priced competitors, so it works best for basic accounting needs rather than complex workflows.

Pricing: TaxAct Business offers affordable monthly pricing starting at $49.95 per month for the basic plan. This plan covers invoicing, billing, time tracking and basic accounting features. Higher priced plans are available for additional features like advanced reporting and payroll.

Some key stats about TaxAct Business include:

– Covers basic invoicing, billing, payroll and accounting needs for small businesses

– Integrates seamlessly with popular accounting programs like QuickBooks and Xero

– Affordable starting price of $49.95 per month for the basic plan

11. Chargebee

Chargebee is an all-in-one SaaS platform for subscription and billing management. Founded in 2011 and based in San Francisco, the company provides an easy to use platform to help companies manage subscriptions, invoices, payments and revenue operations. The platform aims to provide solutions to companies looking to automate and streamline their recurring billing and revenue operations.

Pros: Some key advantages of using Chargebee include:

– Built-in recurring billing and subscriptions functionality

– Full payment processing platform to accept online payments

– Integrations with popular accounting apps like Xero, QuickBooks, Netsuite etc.

– Support for usage-based and tiered pricing models

– Robust API and developer tools for customizations

Cons: One potential disadvantage is that the platform is more suitable for established SaaS and services businesses rather than early stage startups with limited revenues or subscriptions.

Pricing: Chargebee offers a few pricing plans starting from a Free plan for up to $50k in annual recurring revenue. Key paid plans include a Growth plan from $49-149/month and an Enterprise plan with custom pricing based on revenue size and requirements.

Some key stats about Chargebee include:

– Used by over 3,500 companies worldwide

– Processes over $5 billion in annual recurring revenue

– Integrates with over 150 payment gateways and app platforms

– 98% customer retention rate

12. Bench

Bench is cloud-based accounting software designed specifically for small businesses. Founded in 2014, Bench aims to simplify bookkeeping and accounting tasks for entrepreneurs and solopreneurs. With integrated tools for invoicing, expenses, bank reconciliation and reporting, Bench handles all of the back-office paperwork so business owners can focus on growing their company.

Pros: Key advantages of using Bench include:

– All-in-one accounting solution that handles invoicing, expenses, payroll and reporting

– Collaborative workspaces that allow users to invite accountants for assistance

– Real-time dashboards and reports for easy financial oversight

– Integrations with major bookkeeping and invoicing apps like QuickBooks and Xero

Cons: A potential disadvantage is that Bench is exclusively online/cloud-based so an internet connection is required to access financial data and reports.

Pricing: Bench offers straightforward pricing plans starting at $49 per month for the basic plan. Additional features and customizability are available in the Standard ($99/mo) and Premium ($199/mo) plans. All plans include unlimited users and invoices as well as basic accountant collaboration tools.

Some key stats about Bench include:

– Over 100,000 customers worldwide

– Processes over $10B in transactions annually

– Integrates with over 125 banking institutions for easy bank reconciliation

– Staff of over 300 employees including 100+ client support specialists

13. FreeAgent

FreeAgent is accounting software designed specifically for UK small businesses. As a cloud-based solution, it allows users to access their financial data from anywhere via a web browser or mobile app. FreeAgent brings together invoicing, expenses, Self Assessment tax returns, payroll and VAT filing all in one easy-to-use platform.

Pros: Some key advantages of FreeAgent include:

– Cloud-based for easy access from any device

– Powerful reporting capabilities for tracking income and expenses

– Free starter plan available to help businesses get started

– Integrated Self Assessment and payroll modules

– Excellent support directly from FreeAgent

Cons: A potential disadvantage is that the software is mainly designed for UK-based businesses, so may not be as suitable for international firms.

Pricing: FreeAgent offers flexible monthly pricing plans starting from £9/month for the Lite plan up to £36/month for the Premium plan. Discounts are also available for annual subscriptions. A free 30-day trial is available to test the software.

Some key stats about FreeAgent include:

– Used by over 30,000 UK small businesses

– Integrations with over 150 banking, POS and eCommerce platforms

– Real-time dashboard and reports to track finances

– MTD VAT compatible for digital filing

– Flexible pricing plans starting from £9/month

14. Deputy

Deputy is employee scheduling, timesheet and time clock software designed to help businesses save time and stay organized. Founded in 2012, Deputy is based in Australia and serves over 35,000 customers worldwide.

Pros: Some key advantages of Deputy include:

– Robust time tracking functionality that allows employees to clock in/out from any device

– Project management integration that helps tie schedules and timesheets to projects and clients

– Dedicated support for small and medium sized businesses through their pricing plans and support team

Cons: One potential disadvantage is that the mobile apps lack some functionality compared to the web dashboard such as requesting time off. The apps are best used for viewing schedules and clocking in/out rather than managing employees and schedules.

Pricing: Deputy offers three pricing tiers:

– Essentials: $9/month per employee – Best for basic time tracking and scheduling

– Plus: $15/month per employee – Adds approval workflows and customized reports

– Premier: $25/month per employee – Full featured with unlimited teams and admins

Some key stats about Deputy include:

– Used by over 35,000 businesses globally

– Integrations with over 30 platforms including QuickBooks, Xero, and T Sheets

– 24/7 phone and email support

– Mobile apps for iOS and Android

15. Tipalti

Tipalti is a leading global payables automation platform that helps businesses simplify vendor payments, invoicing and compliance. Founded in 2006, Tipalti delivers smart payables that elevate modern business through fully automated, end-to-end solutions.

Pros: Some key advantages of Tipalti include its cloud-based global payables platform which supports over 150 payment capabilities worldwide, real-time approval workflows for invoices and payments, integration with major accounting and procurement systems, and its ability to significantly reduce friction in the vendor payments process.

Cons: One potential disadvantage is that as a SaaS platform, customers are reliant on Tipalti’s systems and services being up-to-date and running smoothly.

Pricing: Tipalti offers transparent and scalable pricing based on the number of monthly payees. Plans start from $99 per month for up to 50 payees.

Some key stats about Tipalti include: processing over $30 billion in annual payments in over 150 currencies to more than 200 countries, supporting more than 1,200 clients globally, and having a customer retention rate of over 97%.

Conclusion

Whether you’re a solopreneaur, professional service firm, or growing business, this guide highlights the top accounting software solutions optimized for Mac users. Reviewing the feature sets, pricing tiers, and real user feedback can help you determine which solution best fits your specific accounting and budget needs to help manage business finances efficiently. The top choices cover a variety of use cases from basic bookkeeping to full-featured ERP platforms. Be sure to evaluate the free trials to find the right accounting partner to help take your business to the next level.