Introduction

Choosing accounting software isn’t easy with so many options on the market. In this guide, we carefully evaluate 15 top accounting solutions based on key criteria like ease of use, features, pricing, integration capabilities, support, and popularity. Our aim is to help small businesses and startups pick the right cloud-based accounting software to power their financial operations in the new year.

Methods of Evaluation

To evaluate and rank the accounting software options, we considered the following factors: pricing and subscription plans, features and functionality, ease of use, integration and third party app support, popularity based on search volume and keyword trends, reviews and ratings from customers, and other metrics like number of backlinks and traffic to company website. We gave higher weightage to solutions with robust feature sets for accounting, invoicing, payments, reporting and compliance at affordable pricing. Usability and reputation strengths were also important signals in our analysis.

1. Dropbox Papers + Add-ons

Dropbox Papers + Add-ons is an accounting software alternative that provides robust accounting capabilities through add-ons to the Dropbox Papers collaboration platform. Dropbox Papers is a note-taking and document collaboration tool similar to Google Docs. Through plugins like Bench Accounting and Receipt Bank, it can function as a full-featured accounting software for individuals and small businesses.

Pros: Advantages of Dropbox Papers + Add-ons for accounting include:

– Free base software provides flexible document storage and collaboration

– Receipt scanning and expense management made seamless with Receipt Bank

– Bench Accounting offers full accounting features like ledger, payables, receivables, and reporting in an integrated package

Cons: The main disadvantage is that Dropbox Papers is not designed specifically for accounting out of the box. Additional plugins are required to gain core accounting features. This makes the setup more complex than a dedicated accounting software.

Pricing: Dropbox Papers itself is free to use. Pricing for add-ons includes:

– Bench Accounting plans start at $12/month

– Receipt Bank plans start at $8/month

Some key features of Dropbox Papers + Add-ons for accounting include:

– Free to use with premium add-ons available for a fee

– Integrates receipt scanning and expense tracking through Receipt Bank

– Online and mobile access for syncing documents and work between devices

– Ledger, invoices, and reporting functionality added through Bench Accounting

2. QuickBooks

QuickBooks is an accounting software developed and marketed by Intuit. As the market leader, QuickBooks has been helping small businesses manage their finances for over 30 years. It offers easy to use accounting tools for tracking income and expenses, managing invoices, paying bills, processing payroll, and more.

Pros: Key advantages of QuickBooks include:

– Intuitive and easy to use interface suitable for beginners

– Great billing and invoicing features to track billable work

– Strong support for sales tax compliance with reporting and filing

– Integrates seamlessly with many popular apps like Stripe, Shopify, Outlook, Gmail etc.

Cons: The desktop version of QuickBooks requires an annual subscription which can get expensive for larger businesses. The online/cloud version has limited offline functionality compared to the desktop version.

Pricing: QuickBooks offers 3 pricing tiers – Simple Start (billed annually starting from $15/month), Essentials (billed annually starting from $25/month), and Plus (billed monthly starting from $35/month). Prices may vary based on the number of users.

Some key stats about QuickBooks:

– Over 7 million customers worldwide

– Processes over $1 trillion in payments annually

– Integrates with over 11,000 third party apps

– Available on Windows, Mac, iOS, and Android

3. SAP Business One

SAP Business One is accounting software developed by German software giant SAP. Originally launched in 2001, SAP Business One is a mid-tier ERP solution tailored specifically for small to midsize businesses. With over 35,000 customers globally across a wide range of industries, SAP Business One aims to provide SMBs with comprehensive functionality typically found in much larger enterprise solutions.

Pros: Some key advantages of SAP Business One include:

– Comprehensive financial and operations modules covering accounting, CRM, inventory, manufacturing, and more

– Flexible workflows and reports to easily track KPIs

– Integrates seamlessly with industry-specific solutions

– Strong global support network with certified implementation partners

Cons: A potential disadvantage is that the upfront license and implementation costs may be higher than some competing mid-market ERP solutions. However, SAP Business One aims to provide additional functionality and extensibility to justify the costs.

Pricing: SAP Business One pricing starts at around $100-150 per user per month depending on the selected edition, number of users, and any additional modules. Implementation support and ongoing maintenance fees will also apply which are usually calculated as a percentage of the initial software costs.

Some key stats about SAP Business One include:

– Used by over 35,000 businesses globally across 140 countries

– Available in 20 languages

– Integrates with over 500 solutions including Shopify, Sage Pastel, Microsoft Dynamics, and more

– Award-winning solutions for industries like manufacturing, distribution, professional services, and more

4. Nola

Nola is an online accounting software designed to simplify bookkeeping for small businesses. Based in New Orleans, Nola aims to make accounting easy and intuitive for non-accountants through its clean interface and integration with other tools.

Pros: Some key advantages of Nola include:

– Beautiful simplicity-focused design that is intuitive for non-finance folks

– Made specifically for non-accountant business owners to easily manage their books

– Seamlessly integrates payroll, invoices, expenses and other tools to simplify financial workflows

Cons: One potential disadvantage is that the software may not have as many advanced features compared to higher-end accounting solutions, which could limit its appeal for more complex bookkeeping needs.

Pricing: Nola offers simple monthly pricing plans starting at $25 per month for the Basic plan (for up to 3 users) and $50 per month for the Premium plan (for up to 5 users).

Some key stats about Nola include:

– Used by over 50,000 small businesses worldwide

– Integrates with over 50+ apps including Shopify, QuickBooks, and Xero

– Named one of the best accounting software for small businesses by PC Magazine in 2023

5. Xero

Xero is an online accounting software for small businesses. It was founded in 2006 and is headquartered in Wellington, New Zealand. The software connects users to their bank, accountant, bookkeeper and other business apps via the cloud.

Pros: Some key advantages of Xero include: [‘Cloud-based solution great for multi-location businesses’,’Strong reporting and analytics capabilities’,’Good mobile app for on-the-go accounting’,’Extensive third party app ecosystem’,’Affordable pricing especially for starting businesses’]

Cons: A potential disadvantage of Xero is that the free tier only allows for 2 users. Small businesses with 3 or more users would need to subscribe to a paid plan.

Pricing: Xero offers various pricing plans starting from a free tier for sole traders up to more feature-rich premium plans for growing businesses. The starter plan is $9 per month billed annually.

Some key stats about Xero include: – Over 2 million subscribers globally across 180 countries – Integrates with over 750 banking connections – Over 50,000 accountants and bookkeepers use Xero – Over 3,000 third party applications can integrate with Xero via the app marketplace

6. FreshBooks

FreshBooks is accounting software specifically designed for freelancers and small businesses. In business since 2004, FreshBooks helps over 24,000 companies manage their finances and has won numerous awards for their user-friendly platform. They offer both basic and premium plans designed for different business needs.

Pros: Some key advantages of FreshBooks include:

– Simple and intuitive to use interface designed for non-accountants

– Focus on invoicing and billing tools to quickly generate and send invoices

– Good option for freelancers and consultants to manage clients and projects

– Reasonable pricing plans for different business sizes and needs

– Strong mobile app allows you to manage your business from anywhere

Cons: One potential disadvantage is that while the intuitive design is great for beginners, more advanced accounting features may be lacking for larger or more complex businesses.

Pricing: FreshBooks offers three pricing tiers:

– Freelancer Plan: $15/month billed annually for up to 3 clients

– Self-Employed Plan: $25/month billed annually for up to 10 clients

– Business Plan: $49/month billed annually for up to unlimited clients

All plans include unlimited invoices, time tracking, expenses, and more.

Some key stats about FreshBooks include:

– Over 24,000 companies use FreshBooks worldwide

– Accepts credit card payments directly in invoices

– Mobile app available for iOS and Android

– Integrates with over 450 apps including QuickBooks, Xero, and Dropbox

– Based in Toronto, Canada

7. Wave

Wave is a free accounting software for small businesses. Founded in 2003 and based in Canada, Wave provides free accounting software, invoicing, receipt scanning and credit card processing for small businesses. It has helped over 3 million businesses get paid on time and stay on top of their finances.

Pros: Some key advantages of Wave include:

– Free basic accounting software with invoicing, receipt scanning and bookkeeping

– Easy setup and onboarding process to get started quickly

– Great free option for sole proprietors and micro-businesses on a budget

– Tight integrations with banking institutions and credit card processors

– Provides automated bookkeeping and receipt capture

Cons: One potential disadvantage of the free version of Wave is limited functionality compared to paid plans. The free plan is best suitable for sole proprietors and very small businesses with basic accounting needs.

Pricing: Wave offers a free tier for basic accounting, invoicing and bookkeeping. It also has paid Business and Advanced plans starting from $25 per month that unlock additional features like expense tracking, time tracking, customization options etc.

Some key stats about Wave include:

– Used by over 3 million small businesses worldwide

– Available for free on desktop and mobile apps

– Integrates with over 2,000 banking institutions

– Processes over $10 billion in credit card transactions annually

8. Avalara AvaTax

Avalara AvaTax is a leading provider of sales and use tax automation software. The software assists businesses in calculating, managing and filing sales tax efficiently and accurately across various jurisdictions.

Pros: Some key advantages of Avalara AvaTax include:

– Automates complex sales tax calculations across multiple locations and tax jurisdictions

– Integrates with most accounting and e-commerce systems to simplify tax processes

– Provides updates on tax rates and rule changes to ensure continuous tax compliance

Cons: One potential disadvantage is that the professional services and/or premium features of Avalara AvaTax can be expensive for some very small businesses with limited transaction volumes.

Pricing: Avalara AvaTax pricing starts from $49 per month for the basic plan with features like tax determination, simplified filing and reporting. Premium versions with advanced capabilities are priced based on business size, transaction volumes and level of integration required.

Some key stats about Avalara AvaTax include:

– Manages tax calculations for over 10,000 ZIP codes and 7,500 tax rates in the US alone

– Supports tax automation in over 55 countries worldwide

– Helps businesses reduce audit risks and penalties by up to 80%

9. TaxAct Business

TaxAct Business is affordable accounting and tax preparation software for small businesses. Developed by TaxAct, one of the leading tax filing software providers, TaxAct Business allows you to file business tax returns, issue 1099 forms, and manage your books in one centralized platform.

Pros: Some key advantages of TaxAct Business include:

– Affordable pricing starting at $49.95 for basic tax filing.

– Mobile access to files, returns and records included.

– Seamless syncing between bookkeeping and tax preparation workflows.

Cons: One potential disadvantage is that the software may not be as fully-featured as more expensive competitors. Advanced reporting and analytics tools are limited compared to higher-priced options.

Pricing: TaxAct Business pricing includes:

– Basic Tax Returns: $49.95

– Deluxe+ State Returns: $99.95

– CompleteWorks: $169.95

All plans include unlimited federal and state e-filing, along with bookkeeping and records access on desktop and mobile.

Some key stats about TaxAct Business include:

– Used by over 1 million small businesses and self-employed individuals each tax season.

– Integrates directly with popular bookkeeping software like QuickBooks.

– Supports Schedule C, Schedule F, Form 1065, Form 1120, Form 1120S and more.

10. Bench

Bench is an online bookkeeping service that offers small businesses an all-in-one accounting platform. Founded in 2014 and headquartered in San Francisco, Bench helps over 15,000 customers streamline their bookkeeping through automated data entry and advanced reporting tools.

Pros: Some of the main advantages of Bench include:

– All-in-one accounting software for things like invoicing, expense tracking, and financial reporting

– Robust reporting features to easily analyze cash flow, profits, and other key metrics

– Integrations allow seamless data transfer between Bench and other business apps

– Dedicated bookkeepers ensure accounts stay organized and up-to-date

Cons: A potential disadvantage is that the accounting work is handled by Bench’s team of bookkeepers rather than being fully automated. This means financial tasks may not be completed as quickly as they would be with self-service software.

Pricing: Bench offers four pricing tiers starting from $49 per month for smaller businesses up to $299 per month for higher volume users. All plans include bookkeeping services, invoicing, expense tracking, and unlimited support from Bench bookkeepers.

Some key stats about Bench include:

– Serves over 15,000 customers worldwide

– Processes over $3 billion in transactions annually

– Integrates with over 45 different apps including Shopify, QuickBooks, Xero, and more

– Provides dedicated customer support from certified bookkeepers

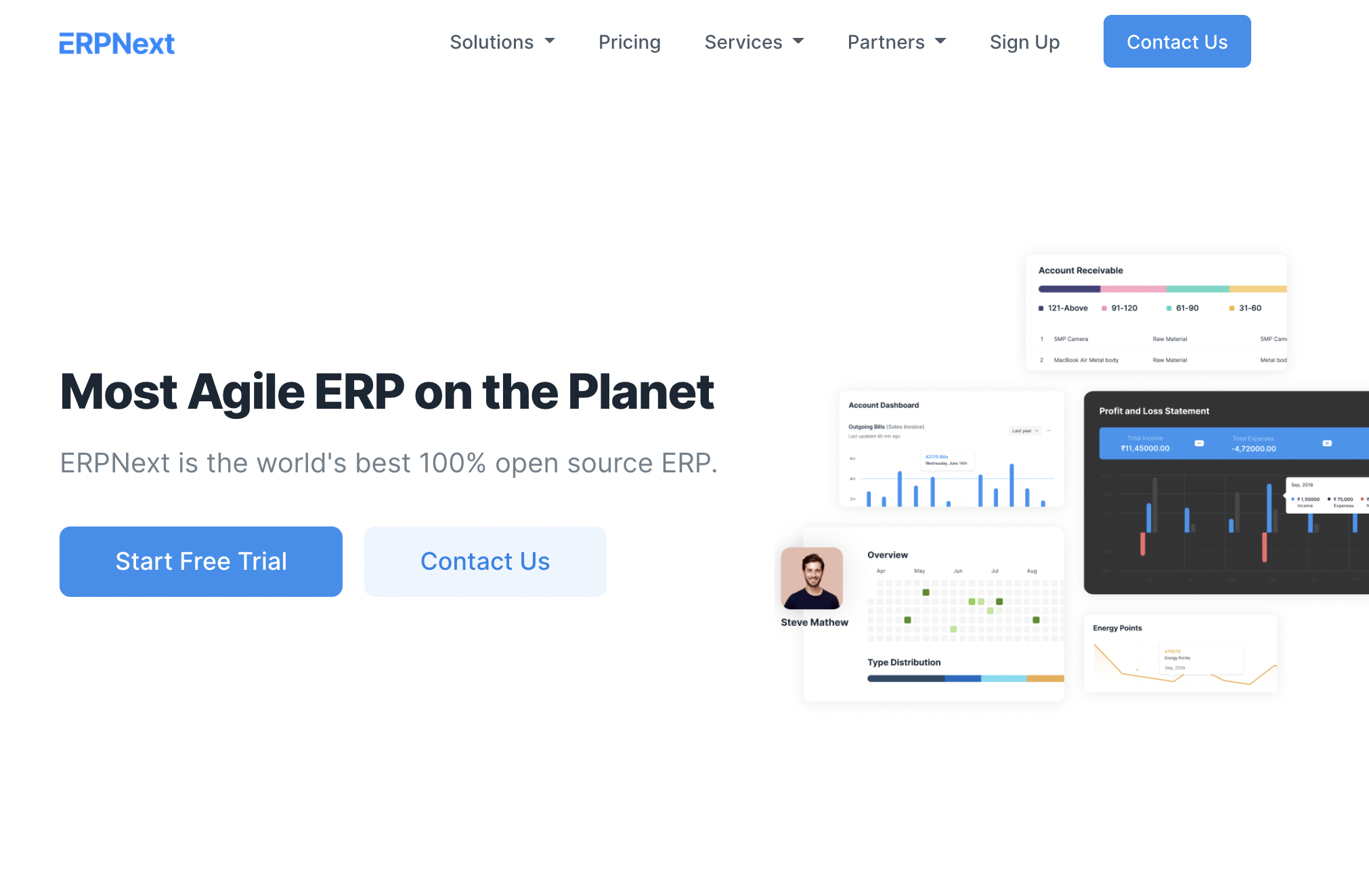

11. ERPNext

ERPNext is an open source ERP software built by Frappe Technologies Pvt. Ltd. It is a feature-rich alternative to proprietary ERP solutions like Microsoft Dynamics, SAP Business One, and Sage 100. ERPNext supports accounting, inventory, CRM and many other business functions in a single integrated platform.

Pros: Key advantages of ERPNext include:

– Open source and customizable to your business needs

– Free to use forever with full access to the source code

– Integrated modules for accounting, inventory, CRM and more

– Cloud or self-hosted options provide flexibility

Cons: Some potential disadvantages of ERPNext include:

– Being open source, it lacks the big vendor support of proprietary solutions

– User interface may not be as polished as paid alternatives

– Limited pre-built connectors compared to solutions like SAP Business One

Pricing: ERPNext has a freemium pricing model:

– Free version for up to 3 users with full access to all features and source code

– Paid plans starting from $25/user/month for customized support and hosting

Some key stats about ERPNext include:

– Used by over 50,000 companies worldwide

– Supports over 30 languages

– Available as a cloud or self-hosted solution

– Integrates with over 80 apps through an App Store

12. FreeAgent

FreeAgent is accounting software designed specifically for UK small businesses. In business since 2006, FreeAgent helps over 40,000 customers manage their finances. It provides a simple, yet powerful solution for invoicing, accounting, expenses and more. FreeAgent’s software is cloud-based, ensuring you can access your financial data from anywhere using any web browser.

Pros: Some key advantages of FreeAgent include:

– Easy to use interface tailored for non-accountants

– automatic VAT calculations and reporting

– Integrated time tracking to easily log billable hours

– Online and mobile access from any device

– Competitively priced starting plans for freelancers and small teams

Cons: One potential downside is the lack of payroll functionality compared to some competitors. FreeAgent is best suited for freelancers, contractors and small businesses without payroll needs.

Pricing: FreeAgent offers transparent monthly pricing plans starting from £6 per month for sole traders up to £36 per month for teams of up to 3 users. All plans include unlimited invoices, bills and expenses. Premium features like bulk invoice creation are available on the higher tier plans.

Here are some key stats about FreeAgent:

– Used by over 40,000 UK small businesses

– Tailored specifically for UK accounting standards and regulations

– Provides integration with over 100 third party tools including Xero, Stripe and QuickBooks

– Mobile apps available for iOS and Android for on-the-go invoicing and expense tracking

13. Deputy

Deputy is a leading employee scheduling, timesheet and time clock software. Founded in 2012 and based in Australia, Deputy allows businesses to easily create staff schedules, track employee timesheets and attendance.

Pros: Some key advantages of Deputy include:

– Powerful time tracking platform that makes it easy to track employee hours, absentees etc

– Auto expense and timesheet entries streamline payroll and billing processes

– Client and project management tools allow easy assignment of jobs/tasks to employees

– Integrated payroll processing functionality reduces manual data entry

– Robust analytics and reporting help analyze productivity, labor costs and more

Cons: One potential disadvantage is that the software is really geared more towards medium-to-large businesses rather than very small operations with just a few employees.

Pricing: Deputy offers three pricing tiers – Basic ($15/month), Pro ($29/month) and Premier (pricing varies based on team size). All plans offer a free 14-day trial.

Some key stats about Deputy include:

– Used by over 40,000 businesses worldwide

– Supports scheduling and time tracking for over 1 million employees

– Integrates with over 50 payroll and accounting systems including Xero, QuickBooks, and FreeAgent

14. Brightpearl

Brightpearl is an online accounting software for retailers and wholesalers. Founded in 2006, Brightpearl is based in London and serves over 4,200 retailers globally. Brightpearl offers a retail operating system (ROS) that automates back office tasks like accounting, inventory management, and reporting to give merchants more time to focus on growth.

Pros: Key advantages of Brightpearl include omnichannel accounting that syncs sales across all retail channels, comprehensive inventory management with controls for multiple locations/warehouses, integrated purchasing and order management, customizable POS and ecommerce integrations, and advanced analytics and reporting.

Cons: A potential disadvantage is that Brightpearl is a more full-featured retail operating system solution best suited for mid-market to enterprise retailers, so it may be overkill for very small businesses or startups on a budget.

Pricing: Brightpearl offers three pricing tiers – Start Up ($99/month), Growth ($199/month), and Enterprise (custom quote). Pricing is based on the number of users, products/items in the catalog, and monthly gross revenue. All plans include support, updates, and integration with major POS systems and shopping carts.

Some key stats about Brightpearl include: serves over 4,200 retailers globally, processes over $8 billion in retail transactions annually, integrated with over 300 POS systems and shopping carts, and available in 8 languages.

15. Tally.ERP 9

Tally.ERP 9 is one of the most popular accounting software in India developed by Tally Solutions. Used by over 5 million businesses in India, Tally.ERP 9 helps organizations manage their finances and business processes easily. It provides a comprehensive suite of business applications like accounting, inventory management, sales invoices, purchase management etc. in one integrated platform.

Pros: Key advantages of Tally.ERP 9 include:

– Popular accounting software for small businesses in India

– Helps with inventory management across multiple locations

– Compliant with GST, e-invoicing and other regulatory requirements

– Provides extensive customization and automation options for workflows

– Dedicated support from Tally across various Indian languages

Cons: One of the key disadvantages is that the software is Windows-only and does not support mobile/cloud access out of the box. Upgraded subscriptions are required for cloud features.

Pricing: Tally.ERP 9 pricing starts from around INR 1500 for a single user license. Volume discounts are available for multiple licenses. Annual support subscriptions starting from 10% of license fees are required for updates and upgrades.

Some key stats about Tally.ERP 9:

– Over 5 million businesses use Tally across India

– Supports multi-location companies with inventory tracking across locations

– Integrates with bank accounts and helps with GST and TDS compliance filing

– Provides customization options for invoices, statements and reports

Conclusion

Choosing the right accounting software depends on your unique business needs. Consider factors like industry, team size, invoicing volume, integration requirements before shortlisting options. Check free trials to understand functionality. Reach out to provider support teams to clarify any gaps. Overall, QuickBooks, Xero, and FreshBooks emerged as top picks based on our evaluation criteria. But other capable solutions like Wave and Bench also scored well for specific business types. Carefully evaluating key factors will help you select the most suitable accounting platform to power your financial operations in 2023 and beyond.