Introduction

With the growing digitization of the mortgage industry, loan origination software (LOS) have become essential tools for lenders to streamline their processes and deliver an enhanced borrower experience. However, with dozens of options in the market, it can be difficult for lenders to identify the right LOS that meets their unique needs and business goals. This blog evaluates the top 15 loan origination software on the market based on key criteria to help lenders make an informed selection.

Methods of Evaluation

The loan origination software are evaluated based on conventional factors like platform features, pricing, configurability, security etc. In addition, metrics like number of backlinks, average traffic and keyword search trends over last six months have also been factored in to assess the market presence and popularity of each software. The software are ranked based on a weighted score obtained across these evaluation parameters to determine the most capable options.

1. Fiserv

Fiserv offers an all-in-one loan origination software solution called Encompass that helps lenders to digitize, automate and streamline the entire loan lifecycle from origination to fulfillment. Encompass is a browser-based platform used by some of the largest lenders in the US to process millions of loans annually.

Pros: Key advantages of Encompass include:

– End-to-end solution to manage the entire loan process from start to finish

– Seamless integrations with other Fiserv solutions for servicing, secondary marketing etc.

– Robust functionality to support complex loan scenarios and customized work flows

– Configurable rules engine for automatic underwriting and compliance checks

Cons: One potential disadvantage is that as a comprehensive platform, Encompass may have more features than needed by smaller or mid-sized lenders. This could increase the cost and complexity of the system relative to more scoped offerings.

Pricing: Pricing for Encompass is typically based on the number of loans originated per month. Indicative starter pricing is around $3,000/month for up to 50 loans/month. Volume-based discounts are available for higher tier plans.

Some key stats about Fiserv’s Encompass LOS include:

– Used by over 850 lenders to process over $1 trillion in mortgages annually

– Supports origination of all types of mortgage loans including purchase, refinance, FHA, VA, USDA and jumbo loans

– Integrates with 3000+ systems and APIs

2. FICS

FICS is a loan origination software developed and offered by Finastra, one of the largest fintech companies in the world. Finastra has over 90 years of experience in the financial technology industry and provides a broad portfolio of lending, leasing, treasury and retail/commercial banking solutions. FICS is their core loan origination platform used widely by financial institutions globally.

Pros: Some key advantages of FICS include: – Strong capabilities for wholesale and correspondent lending – Feature-rich platform from an established fintech leader – Highly customizable solutions to meet individual lender needs – Dedicated client support teams for implementations and ongoing support

Cons: A potential disadvantage is the high upfront costs for implementation and customization given Finastra’s position as an established industry leader.

Pricing: Pricing for FICS is based on the size and needs of the financial institution. It is typically sold as a subscription-based SaaS offering with costs including annual software licensing fees, implementation services, custom configurations, and ongoing support packages.

Some key stats about FICS include: – Used by over 300 financial institutions in North America – Supports annual origination volumes of over $500 billion – Configurable for retail, commercial, and consumer loan types – Integrates with over 50 platforms and systems

3. Black Knight

Black Knight is a leading provider of integrated software, data and analytics for the mortgage and real estate industries. Their flagship product is their MSP loan origination system which supports the end-to-end loan life cycle from origination to servicing. With over 20,000 users, MSP is used by some of the largest banks, credit unions and mortgage lenders in the country.

Pros: Some key advantages of Black Knight MSP include: a comprehensive suite of solutions that span the entire loan process beyond just origination, specialized features and capabilities optimized for large scale/enterprise lenders, and end-to-end support with integrated solutions that allow for streamlined workflows.

Cons: A potential disadvantage is the large upfront costs and implementations times that come with specialized enterprise systems of this size and scale. It may not be suitable for some smaller and mid-sized lenders.

Pricing: Pricing is customized based on features, volume and needs. Black Knight employs a standard software-as-a-service model with monthly subscription fees. Implementation and setup can range from $50,000 to over $500,000 depending on the project scope.

Some key stats about Black Knight’s MSP loan origination system include: supports over 15 million active loans on the platform, integrated with 30+ credit bureaus and validators, processes over $3 trillion in annual mortgage volume.

4. Ellie Mae

Ellie Mae is an industry leader in mortgage loan origination software, with over 30 years of experience serving the mortgage industry. As the leading digital platform for streamlining the entire loan origination process, Ellie Mae software is widely used by many of the largest banks and lenders in the US.

Pros: Some key advantages of Ellie Mae include:

– Comprehensive platform that supports the entire origination workflow from beginning to end

– Deep integration capabilities with 3rd party systems and data sources

– Robust set of features to streamline processes, ensure compliance, and automate manual tasks

– Widely used and trusted platform with a proven track record of success

Cons: A potential disadvantage is the upfront cost, as Ellie Mae has pricing tiers based on monthly closed loan volume that can be substantial for smaller lenders. However, this is offset by many hidden cost savings from operational efficiencies.

Pricing: Ellie Mae offers flexible monthly subscription pricing based on a lender’s monthly closed loan volumes. Pricing ranges from around $3,000/month for the smallest tier up to $30,000/month or more for the largest enterprise lenders.

Some key stats about Ellie Mae include:

– Serves over 70% of all US mortgage transactions

– Over 15,000 active users each month

– Supports over 450,000 monthly closed loans

5. MeridianLink

MeridianLink is a leading digital lending software provider that offers a full suite of loan origination solutions. Founded in 2000 and headquartered in Costa Mesa, California, MeridianLink is focused on helping financial institutions improve and automate their lending operations through its digital lending platform.

Pros: Key advantages of MeridianLink’s digital lending platform include:

– Cloud platform that provides modern workflows to improve efficiency

– Integrates seamlessly with other systems used across lending operations

– Specialized solutions for multi-channel loan origination and distribution

Cons: A potential disadvantage is that, as a larger player in the space, MeridianLink may lack some customization options compared to smaller vendors.

Pricing: MeridianLink offers flexible pricing models including perpetual licenses and annual/monthly SaaS subscriptions. Pricing is typically based on number of users, monthly volume, and additional features/integrations required.

Some key stats about MeridianLink include:

– Processes over $500 billion in loan volume annually

– Supports over 1,000 financial institutions globally

– Integrates with over 200 core banking and secondary market providers

6. Blend

Blend is a leading digital lending platform that provides loan origination software and solutions. Founded in 2013 and headquartered in San Francisco, Blend empowers lenders like Wells Fargo, U.S. Bank and PNC to streamline lending and digitally engage customers throughout the entire lifecycle of a loan. With over 500 institutions partnered with Blend to deliver mortgages, personal loans, and more impacting millions of customers.

Pros: Some of the key advantages of Blend include:

– Cloud-based platform suitable for all lender types including banks, credit unions, mortgage lenders etc.

– Advanced digital capabilities for streamlined loan origination online and on mobile

– Integrations with 160+ systems allow lenders to manage the entire loan lifecycle

– Strong capabilities for point-of-sale (POS) loan fulfillment and eClosing

Cons: A potential disadvantage is that the platform requires significant configuration and setup during implementation which can take time for larger institutions.

Pricing: Blend pricing consists of simple per-loan pricing that varies based on loan size and type. It offers tiered monthly subscription plans starting at $2,500/month for smaller lenders originating under $50M annually. Larger enterprise clients have customized pricing offered on a case by case basis.

Some key stats about Blend include:

– Processed over $530 billion in loans since 2013

– Supports lending in all 50 US states

– Supports multiple lending types including mortgages, consumer lending, small business loans, auto loans and more

– Works with 17 of the top 25 US banks

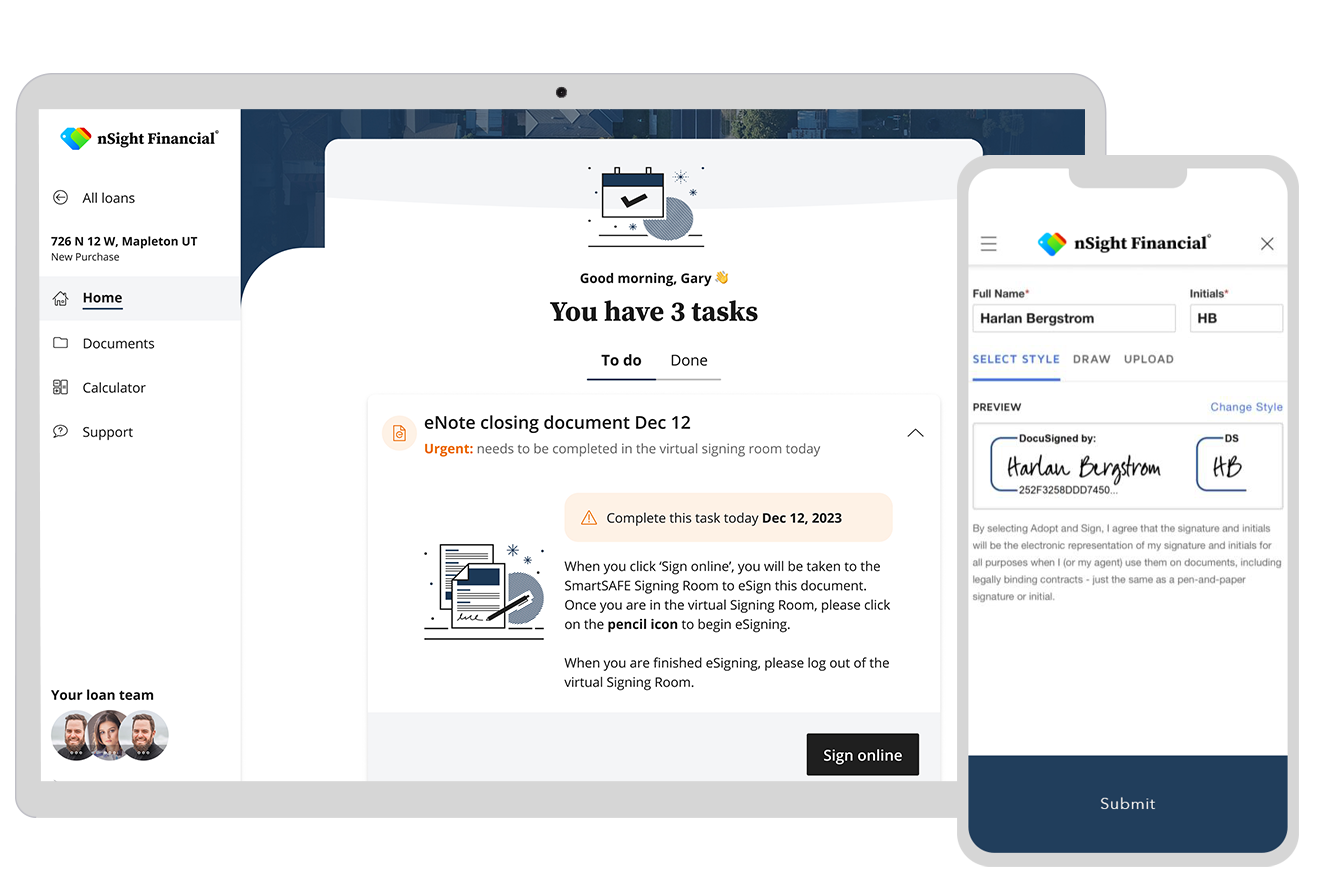

7. SimpleNexus

nCino Mortgage Suite is a cloud-based loan origination system developed by nCino for mortgage lenders. The platform offers a comprehensive suite of tools to streamline the entire loan process from origination to closing.

Pros: Some key advantages of nCino Mortgage Suite include:

– Cloud-based with strong mobile capabilities

– Comprehensive POS, CRM and digital tools

– Suitable for both retail and wholesale lenders

Cons: A potential disadvantage is that the platform requires an internet connection to access all features which may not be suitable for some originators who need offline functionality.

Pricing: nCino Mortgage Suite pricing is based on a per-user monthly subscription model starting at $50 per user per month for breakthrough packages. Enterprise packages with additional features are also available with customized pricing.

Some key stats about nCino Mortgage Suite include:

– Used by over 110 financial institutions in North America

– Processes over $150 billion in loans annually

– Mobile apps available for iOS and Androidwith offline capabilities

nCino Mortgage SuiteTake a look at nCino’s nCino Mortgage Suitesimplenexus.com

8. SoftPro

SoftPro is a leader in real estate closing and title insurance software. Founded in 1984, SoftPro has been providing loan origination and closing software solutions to banks, credit unions, and title and escrow companies. Their flagship product, SoftPro, is a comprehensive loan origination and closing platform tailored for the mortgage industry.

Pros: Some key advantages of SoftPro include:

– Comprehensive capabilities suited for banks and credit unions with configurable workflows

– Customizable interface that can be tailored to your business needs and processes

– Robust document imaging and storage for easy access and retrieval of documents

Cons: A potential disadvantage is the upfront costs – SoftPro is an enterprise solution so there is a larger initial investment required compared to some other loan origination options.

Pricing: SoftPro offers flexible pricing models based on your needs and transaction volume. Pricing is available through a quote on their website. Implementation, training and support services are also available as an added cost.

Some key stats about SoftPro include:

– Used by over 1,000 clients in North America

– Processes over $1 trillion in transactions annually

– 30+ years of experience in real estate and mortgage software

– Handles all types of real estate transactions from purchase to refinance

9. LendingHome

LendingHome is an end-to-end loan origination platform used by hundreds of mortgage lenders nationwide. The platform digitizes the entire lending process from lead capture and application to underwriting, closing and servicing.

Pros: Some key advantages of LendingHome include:

– Digitally focused platform for purchase and refinance loans

– Streamlined POS functions integrated directly into the platform

– Specialized in non-QM and niche products like rehab loans

Cons: A potential disadvantage is that the platform is more suited for mid-large size lenders and may have more features than needed for smaller lenders.

Pricing: LendingHome pricing starts at $1,500 per month for origination only. Additional fees apply for other modules like underwriting, fulfillment etc. Volume discounts are available for lenders originating over $100 million annually.

Some key stats about LendingHome include:

– Originated over $50 billion in loans since launching in 2013

– Supports purchase, refinance, FHA, VA and non-QM loans

– Integrates with 40+ third party systems like MLS, CRM, accounting etc.

10. DocMagic

DocMagic is a leading provider of digital mortgage document preparation and eClosing solutions. Founded in 1987, DocMagic has helped thousands of lenders and settlement agents streamline their processes. Their flagship products LoanDocument and eVault help lenders originate, process, and close loans fully online.

Pros: Some key advantages of DocMagic include:

– Integrates seamlessly with top LOS systems for a seamless workflow

– Advanced eClosing capabilities allow for a fully paperless and digital closing process

– Customizable document preparation templates to fit any lender’s needs

– Built-in compliance checks help ensure all documents are properl prepared

Cons: One potential disadvantage is that the eClosing process requires buy-in from all parties involved like the lender, borrower, and settlement agent. If any part lacks the proper technology this could slow down the process.

Pricing: DocMagic offers flexible pricing plans ranging from $99 – $249 per closing. They also offer an annual Software as a Service (SaaS) subscription starting at $2,995 per year which provides unlimited closings and support.

Some key stats about DocMagic include:

– Over 30 years in business

– Used by over 450,000 users

– Integrates with all major LOS systems like Ellie Mae, Black Knight, and Fiserv

– Processed over $1 trillion in loan volume

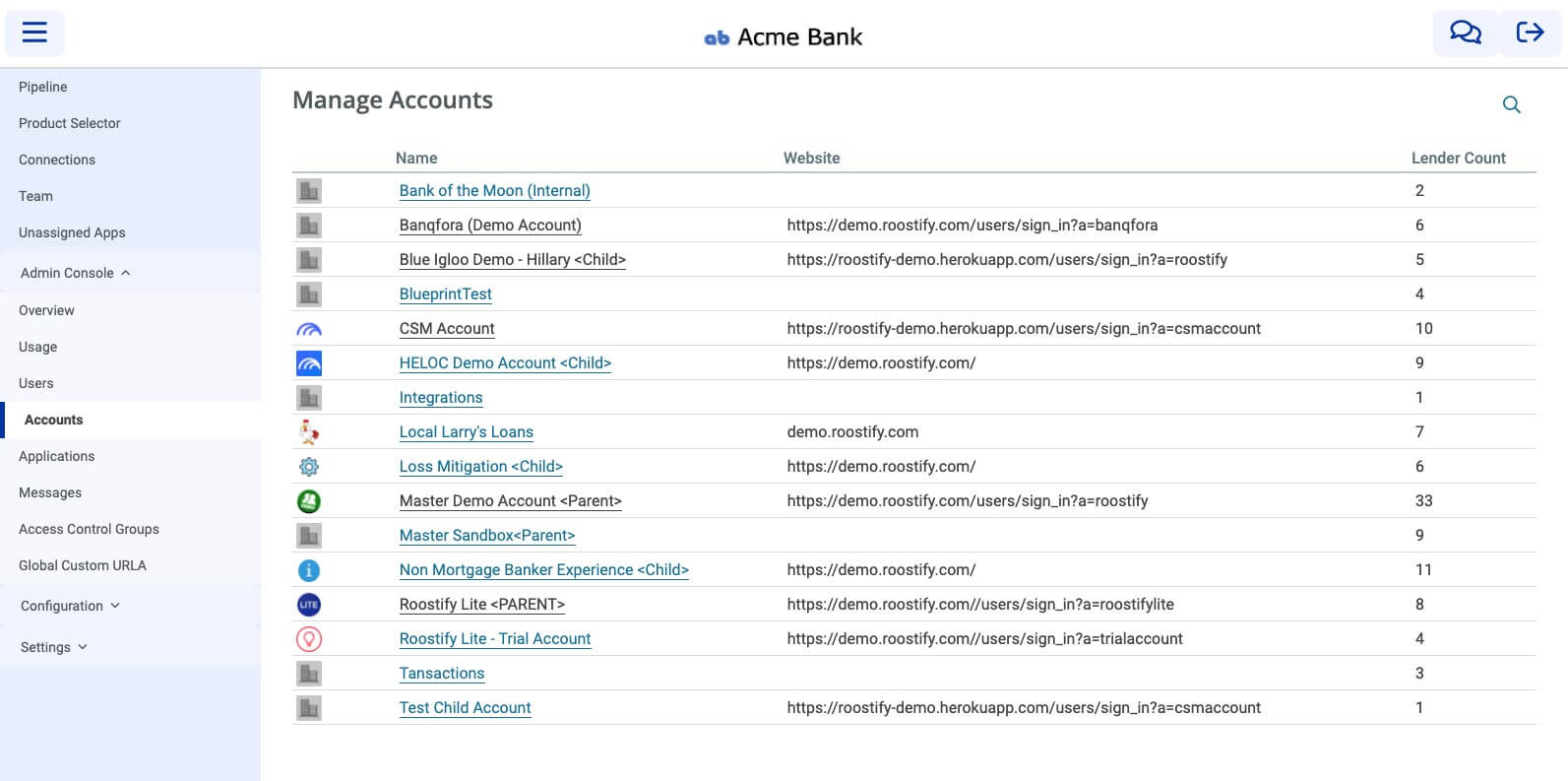

11. Roostify

Roostify is a cloud-based digital mortgage platform focused on streamlining the origination process and providing a seamless borrower experience. The platform aims to revolutionize the borrower’s journey, starting from the initial point of sale. Roostify offers integrated POS capabilities, predictive tools to help homebuyers determine their mortgage options upfront, and a streamlined workflow to help lending teams work more efficiently from lead to close.

Pros: Some key advantages of Roostify include:

– Cloud-based platform that allows lending teams to work from anywhere

– Integrated point-of-sale capabilities to capture leads and run initial estimates

– Predictive analytics and scenarios engine to help buyers understand options upfront

– Automated workflows and tasks to streamline the origination process

Cons: A potential disadvantage is that the full capabilities of the platform may require adjustments to existing workflows for some lenders.

Pricing: Roostify offers customizable pricing plans tailored to individual lenders’ needs and volume. Generally plans are priced on a per-loan or per-user monthly fee along with potential implementation and training fees.

Some key stats about Roostify include:

– Used by over 300 lenders nationwide

– Processed over $500 billion in loan volume since inception

– Average time savings of 7 days on the loan origination process

12. Process Fusion

Process Fusion is an all-in-one digital lending platform designed for banks and credit unions. The platform allows lending institutions to streamline their loan origination process from application to closing. Process Fusion offers digital transformation solutions including secure information exchange and business process automation.

Pros: Some key advantages of Process Fusion include:

– All-in-one digital lending platform for end-to-end loan origination

– Streamlined fulfillment process that speeds up the loan process

– Integrates with a wide range of third party systems for easy data exchange

– Highly configurable to meet each institution’s specific needs and processes

Cons: One potential disadvantage is the upfront costs of implementation which can be significant for larger institutions. However, Process Fusion aims to offer a quick ROI through improved efficiencies.

Pricing: Pricing for Process Fusion depends on the size and needs of each institution. Feature-rich starter plans are available for smaller lenders starting at $1,000/month. Larger enterprise accounts with customized configurations are priced on a case by case basis through an assessment of requirements.

Some key stats about Process Fusion include: It can integrate with over 300 different systems out of the box. It is used by over 500 financial institutions. Process Fusion boasts a customer retention rate of over 95%.

13. Capsilon

Capsilon is a leading provider of loan origination software. Founded in 1997, Capsilon has become one of the most popular choices for mid to large sized lenders looking to automate underwriting, compliance, and workflows. With offices across the US, Canada, and India, Capsilon serves over 200 financial institutions.

Pros: Some key advantages of Capsilon’s loan origination software include:

– Automated underwriting and workflows to speed up the loan process

– Advanced analytics and pricing engine to help lenders make smarter decisions

– Robust compliance features to help reduce fraud and ensure adherence to guidelines

Cons: One potential disadvantage is that the software may require more implementation time and resources for very large and complex lenders compared to some other options.

Pricing: Capsilon offers flexible pricing models based on volume tiers. Low volume lenders generally pay monthly software-as-a-service fees while larger lenders often negotiate an annual enterprise license. Implementation, custom configuration and support are extra and based on requirements.

Some key stats about Capsilon include:

– Processes over $1 trillion in mortgage volume annually

– Used by 15 of the top 25 retail lenders

– Supports 65+ investor/insurer guidelines out of the box

14. BYTE Software

BYTE Software provides loan origination software (LOS) to help lenders digitally transform their origination process. Their flagship product, the BYTE LOS, is a comprehensive, cloud-based platform designed for mortgage brokers, banks, and credit unions to manage the entire loan lifecycle from origination to closing.

Pros: Some of the key advantages of the BYTE LOS include:

– Comprehensive platform that supports both mortgage and non-mortgage lending

– Highly configurable interface that can be tailored to your workflows

– Robust reporting and analytics to provide insights into portfolio performance

Cons: Potential disadvantages could include the upfront cost of implementation and need for customization. However, BYTE aims to provide an affordable, scalable solution for lenders of all sizes.

Pricing: BYTE offers flexible pricing plans depending on features needed. On-premise solutions start at $5,000 per month while their cloud-based platform starts at $1,500 per month. Implementation, custom configuration and add-on services are priced separately.

Some key stats about the BYTE LOS include:

– Used by over 450 lending institutions nationwide

– Processes over $150 billion in loan volume annually

– 30+ integrated third-party systems for seamless data exchange

– Customizable to fit any lending business model or niche market

15. OpenClose

OpenClose is a leading digital mortgage lending platform provider founded in 2002. Their cloud-native, API-first technology is used by lenders of all types including independent mortgage banks, depository institutions, credit unions, and correspondent lenders. With over 20 years of experience, OpenClose provides lenders end-to-end functionality to power their origination and secondary marketing operations.

Pros: Some key advantages of OpenClose’s loan origination software include:

– Comprehensive capabilities for lenders of all types from retail to wholesale and correspondent channels

– Powerful POS and CRM solutions integrated into a centralized platform

– Leading cloud-native platform allowing dynamic scalability and redundancy

Cons: A potential disadvantage is that as a more full-featured platform, it may have a higher total cost of ownership than some more basic options. However, OpenClose aims to offset this with efficiencies gained from automation and integrated capabilities.

Pricing: OpenClose offers flexible pricing models ranging from a billed per loan or monthly subscription based on volume. They also offer initial implementation packages to set up the software. Contact OpenClose for a tailored quote based on your specific business needs and volume.

Some key stats about OpenClose include:

– Used by over 150 enterprise lenders

– Processed over $1 trillion in loan volume since inception

– Fully digital and paperless platform

Conclusion

While all the loan origination software covered in this blog are strong players in their own right, the top options based on the comprehensive evaluation are Fiserv, Finastra, Black Knight and Ellie Mae. They achieved the highest scores due to their end-to-end capabilities, integration with other systems, customization abilities and large client bases. However, lenders must also evaluate their unique business needs before selecting the right LOS. With digital mortgage expected to gain further steam, loan origination software will play an ever more critical role in 2023 and beyond.