Introduction

Building wealth through long-term investing requires having the right tools to manage your portfolio effectively. There are many investment and portfolio tracking software options on the market today to help both experienced and novice investors grow their money. In this post, we analyze and compare 14 of the most popular investment portfolio management tools based on features, costs, ease of use and other factors to identify the best options for building wealth in 2023 and beyond.

Methods of Evaluation

To evaluate and rank each portfolio management solution, we considered the following criteria: functionality and features offered, costs and fees, quality of customer support, online reviews and ratings, number of clients/accounts, backlink profile and website traffic, mobile app experience, and overall reputation in the industry. Specific factors like basic vs advanced tools, types of accounts supported (retirement, taxable, etc), automatic rebalancing, tax-loss harvesting, research tools and educational resources were also assessed. The companies were then ranked based on their performance across these conventional evaluation methods in addition to leveraging their number of high-quality backlinks, website traffic trends, and keyword ranking.

1. Morningstar Office

Morningstar Office is an all-in-one investment research, portfolio management and reporting platform developed by Morningstar, a leading provider of independent investment research. Launched in 1992, Morningstar Office allows users to conduct in-depth research, construct customized portfolios, monitor performance, and generate detailed reports.

Pros: Some key advantages of Morningstar Office include:

– Powerful research and data analytics platform with extensive fund and market data

– Ability to analyze and construct customized model portfolios across multiple accounts

– Generate customized client reports and presentations directly within the platform

– Widely used and recognized tool for investment professionals and advisors

Cons: A potential disadvantage of Morningstar Office is that the pricing can be expensive for smaller firms or individual investors due to costly monthly subscription fees. However, it provides significant value for larger advisory firms managing billions of dollars in AUM.

Pricing: Morningstar Office pricing starts at $1,500 per month for the basic Individual Investor edition. Most advisory firms will need the higher-tier Advisor, Team, or Enterprise editions which range from $3,000 to over $10,000 per month based on number of users and additional premium data feeds.

Some key stats about Morningstar Office include:

– Used by over 3,500 investment firms and advisors globally

– Provides data on over 47,000 investment vehicles including stocks, mutual funds, ETFs, separately managed accounts, hedge funds, and private placements

– Offers over 30 years of historical returns, ratings and risk data

– Supports multi-currency portfolio reporting in over 160 different currencies

2. BlackRock iRetire

BlackRock iRetire is an online investment and retirement planning tool from BlackRock, one of the largest asset management firms in the world. iRetire provides goals-based financial planning and investment portfolios designed for retirement. The platform offers investors retirement target-date funds, educational resources, and a basic robo-advisory option.

Pros: Some key advantages of BlackRock iRetire include:

– Backing and resources of a giant global asset manager.

– Low-cost, diversified target-date portfolios for set-and-forget retirement investing.

– Basic robo-advisory option for those wanting portfolio adjustments.

– Educational resources and retirement planning tools.

Cons: The main disadvantage is that the basic free version has limited features compared to paid robo-advisors. Advanced services like tax-loss harvesting and customized portfolios require an ongoing subscription fee.

Pricing: BlackRock iRetire has both free and paid options:

– Free basic accounts with just target-date funds and basic planning tools. No minimum balance required.

– Paid ‘Advisor’ accounts start at 0.30% per year on balances over $5,000 for full robo-advisory services.

Some key stats about BlackRock iRetire include:

– Over $9 trillion in assets under management by BlackRock globally.

– Millions of users of the iRetire retirement planning tool.

– Over 150 target-date retirement funds covering all risk profiles and time horizons.

3. Schwab Intelligent Portfolios

Charles Schwab offers Schwab Intelligent Portfolios, a robo-advisor service that builds and manages investment portfolios for clients. Using sophisticated algorithms, Schwab Intelligent Portfolios creates customized, globally diversified portfolios across major asset classes to suit each client’s goals, timeline and risk tolerance.

Pros: Some key advantages of Schwab Intelligent Portfolios include: it offers comprehensive access via the Schwab mobile app. Clients get access to Schwab’s extensive research tools and investment guidance. It has a low minimum account size of $5,000 to get started.

Cons: A potential disadvantage is that the account management is fully automated without personal financial advisor support.

Pricing: Schwab Intelligent Portfolios charges an annual advisory fee of 0.28% of assets under management for balances up to $500,000. The minimum account size to get started is $5,000.

Some key stats about Schwab Intelligent Portfolios include: it has over $100 billion in assets under management. It has a low minimum account balance of just $5,000 to get started. Accounts are charged an annual 0.28% advisory fee on balances up to $500,000.

4. IG Portfolio

IG Portfolio is an all-in-one portfolio and trading platform provided by London-based IG Group. With over 200 years of combined stockbroking experience, IG provides global traders with competitive pricing, extensive choice and powerful platforms to manage investments.

Pros: Some key advantages of IG Portfolio include:

– Trading platform for stocks, ETFs, forex and CFDs

– Portfolio tracker and performance/risk reporting

– Educational resources and signals for traders

Cons: A potential disadvantage is that IG Portfolio is best suited for active trading rather than longer-term ‘buy and hold’ investing due to the costs involved with CFDs and other leveraged products.

Pricing: IG Portfolio is free to use for the basic portfolio tracker and research tools. Trading on the platform incurs variable spread costs for products like CFDs and FX, with margined leverage available subject to account status.

Some key stats about IG Portfolio include:

– Over 300,000 active clients globally

– £700 billion worth of assets under administration

– Regulated by the UK Financial Conduct Authority (FCA)

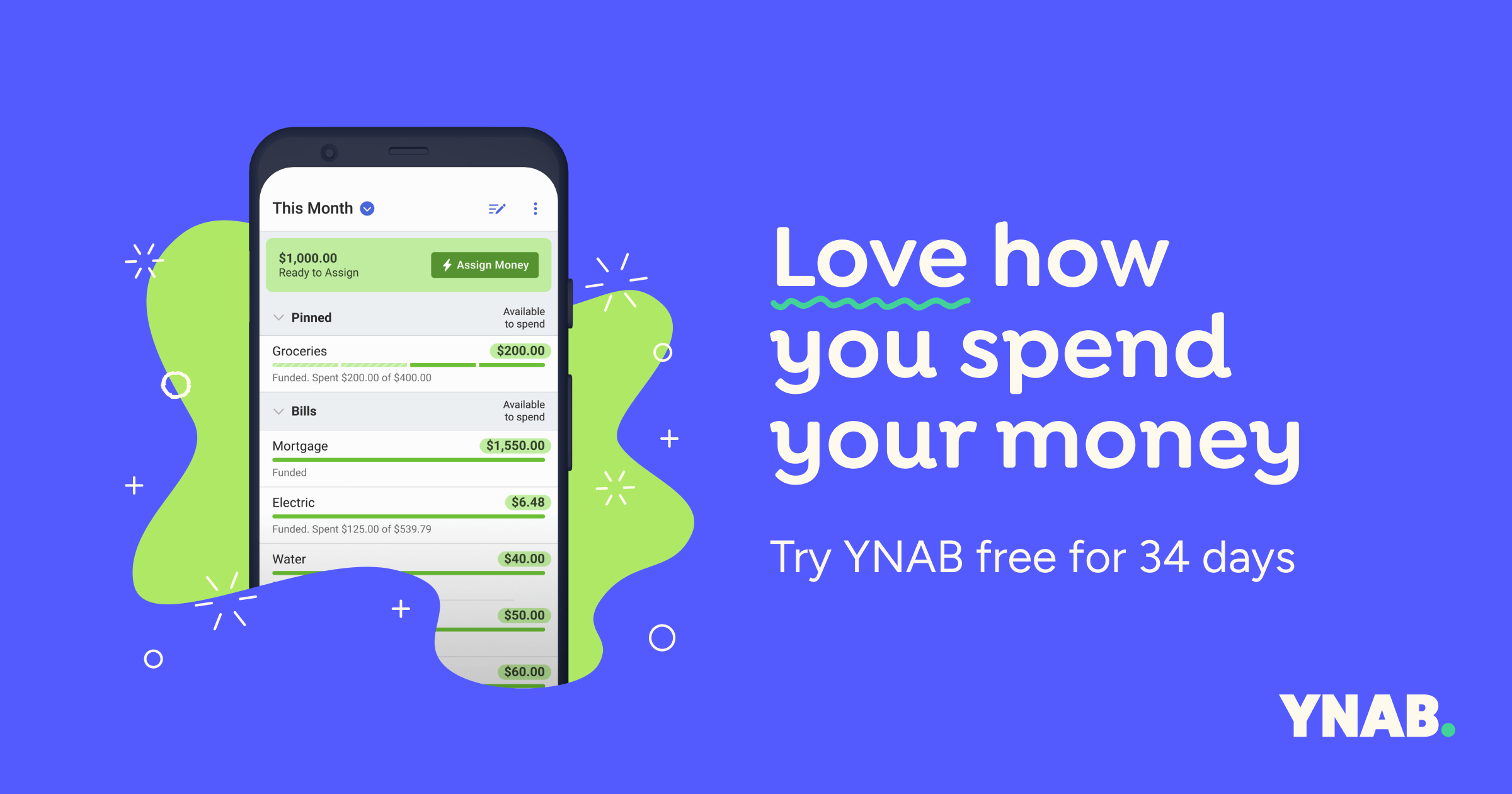

5. You Need a Budget (YNAB)

You Need a Budget (YNAB) is a popular personal finance software that helps users budget, track spending, and save money. Developed by the fintech company YNAB, it uses a zero-based budgeting methodology where all of a user’s earnings are allocated to specific spending and saving categories for each month. This forces users to truly understand where their money is going each month.

Pros: Some key advantages of YNAB include: – Its focus on zero-based budgeting methodology which is effective for planning cash flows – Strong mobile apps that allow frequent access to budgets anywhere – Intuitive interface that is easy for beginners to learn budgeting – Automatic import of transaction data from linked bank accounts

Cons: The key disadvantage is that YNAB uses a subscription model starting at $84 per year rather than a one-time payment which can be more expensive long-term.

Pricing: YNAB offers three subscription plans: – Basic digital plan for $84 per year which supports one user – Premium digital plan for $99 per year which supports unlimited users and includes features like reports – Students can get a free 1-year subscription at youneedabudget.com/edu

Some key stats about YNAB include: – Over 2 million users globally as of 2022 – Users on average save over $600 in the first year – Budgets are based on what money users have now rather than what they will have later – Focuses on the four rules of budgeting including giving every dollar a job

6. Quicken

Quicken is one of the most popular personal finance software for managing budgets, tracking spending, and accessing all your financial accounts in one place. Developed by Quicken Inc., it has been available since the 1980s and is used by millions of households to manage their money.

Pros: Some key advantages of using Quicken include:

– Intuitive and easy to use interface

– Robust budgeting, expense and account tracking features

– Automatic import of transaction data from linked bank accounts

– Ability to track investments, loans and multiple accounts in one place

– Large library of reports and charts to analyze spending habits

Cons: A potential disadvantage is that it is primarily designed for individual use rather than for professional portfolio managers overseeing multiple accounts.

Pricing: Quicken offers various subscription plans starting from $34.99 per year for basic personal finance tracking on a single device up to a $99.99 per year plan that allows syncing across unlimited devices and includes enhanced budgeting and planning tools.

Some key stats about Quicken include:

– Over 10 million users worldwide

– Supports connection to over 11,000 financial institutions for automatic transaction import

– Over 35 years of developing personal finance software

– Available on Windows and Mac operating systems

7. Betterment

Betterment is an online investment platform that helps individuals manage their investment portfolios. Founded in 2008 and headquartered in New York, Betterment takes the burden of portfolio management off its customers by offering automated portfolio recommendations and management based on a customer’s goals, timeline, and risk tolerance. With over $30 billion in assets under management, Betterment is one of the largest digital wealth managers in the United States.

Pros: Some key advantages of using Betterment include:

– Simple setup process with no trading fees

– Advanced features like automatic deposits, spending and savings goals

– Tax-efficient portfolio management through features like tax-loss harvesting

Cons: A potential disadvantage is that Betterment customers don’t have full control over their portfolio and investment choices since Betterment manages everything automatically based on the customer’s profile.

Pricing: Betterment offers two plans – Betterment Digital which charges 0.25% of your assets per year and Betterment Premium which charges 0.40% of your assets per year. Accounts under $100,000 are charged a $3/month custody fee as well.

Some key stats about Betterment include:

– $30+ billion in assets under management

– Over 450,000 customers

– 0% trading fees

– Tax-loss harvesting for taxable accounts to maximize after-tax returns

– Automatically rebalancing portfolios

8. Wealthsimple

Wealthsimple is a leading investment management and financial planning company based in Canada. Founded in 2014, Wealthsimple has grown to manage over $12 billion for over 500,000 clients throughout Canada and the United States. They offer a comprehensive robo-advisor platform for both novice and experienced investors.

Pros: Some of the key advantages of using Wealthsimple include:

– Comprehensive robo-advisor platform suitable for all types of investors from beginners to experts

– Very low fees for automated and hands-off portfolio management

– Excellent mobile apps and web interfaces for easy access and management on the go

– Strategy based investing approaches with ETF portfolios tailored to risk tolerance

– Personalized financial planning tools and retirement projections

Cons: A potential disadvantage of Wealthsimple is that their investing options are limited to ETF portfolios only with no ability to select individual stocks. Some investors may prefer a platform that offers more flexibility and control over their portfolio selections.

Pricing: Wealthsimple offers very competitive pricing for their automated portfolio management services. For non-registered or taxable accounts, fees are 0.50% annually on the first $100,000 and only 0.40% on amounts over $100,000. For registered accounts like TFSAs and RRSPs fees are even lower at 0.40% annually on all amounts.

Some key stats about Wealthsimple include:

– Manage over $12 billion in assets for over 500,000 clients

– Offer low-cost portfolio management with fees as low as 0.5%

– Available in Canada and the United States

– Over 150 employees

– Backed by some of Canada’s largest financial institutions like Power Financial, Royal Bank of Canada, and Greylock

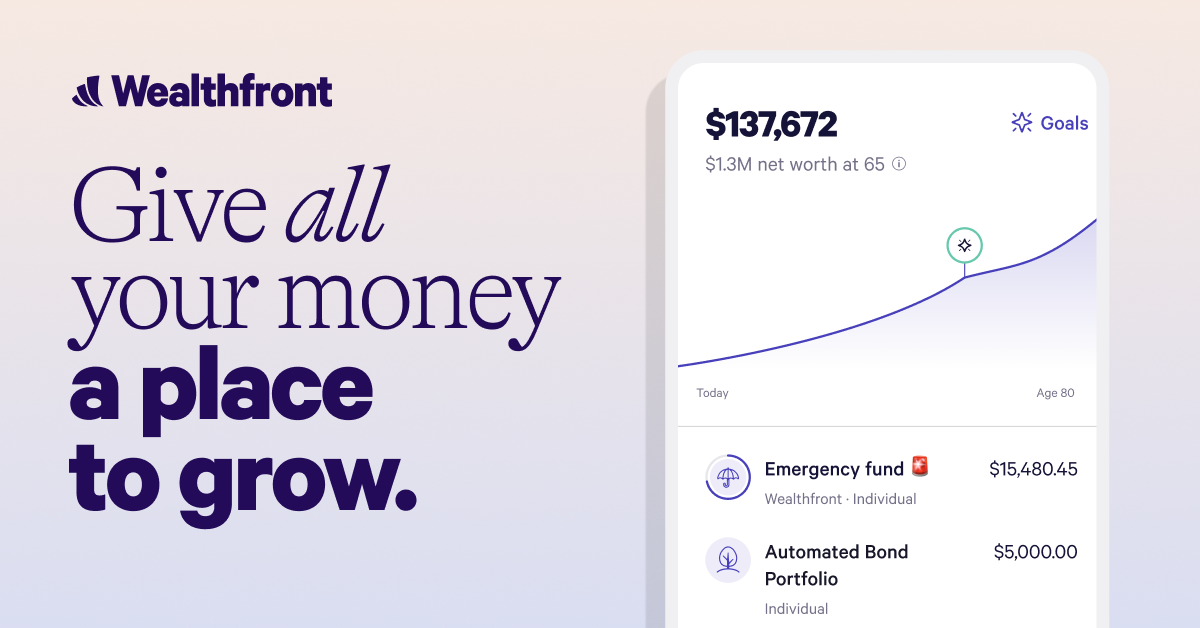

9. Wealthfront

Wealthfront is an automated investment management platform that offers portfolio management and financial planning services. Founded in 2008 and headquartered in Palo Alto, California, Wealthfront uses algorithm-based portfolio management to build and maintain personalized investment portfolios for its clients. Using a number of financial data sources, Wealthfront analyzes global markets and rebalances portfolios on a daily basis to maintain target asset allocations. The service is designed to be hands-off for clients and automate both portfolio construction and ongoing maintenance.

Pros: Some of the key advantages of using Wealthfront include:

– Low cost automated investment management without high fees associated with traditional advisors

– Robo-advisor technology performs regular portfolio rebalancing to maintain a target asset allocation

– Provides tax-loss harvesting services to help offset capital gains

– Minimum account size of just $500 makes it accessible for those just starting to invest

Cons: One potential disadvantage of Wealthfront is that clients have less ability to customize portfolios compared to working directly with a financial advisor.

Pricing: Wealthfront charges an annual advisory fee based on account balance, ranging from 0.25% for balances up to $100,000 down to 0.08% for balances over $1,000,000.

Some key stats about Wealthfront include:

– Over $25 billion in assets under management

– More than 275,000 clients

– Minimum account size of just $500 to get started

– Provides tax-loss harvesting services to help reduce capital gains taxes

10. Personal Capital

Personal Capital is a popular investment portfolio management software that offers both free and paid subscription plans. Founded in 2009 and based in San Francisco, Personal Capital helps over 2 million people take control of their finances with both desktop and mobile applications.

Pros: Some of the key advantages of Personal Capital include:

– Free to use basic financial planning and net worth tracking tools

– Advanced portfolio analysis, reporting and performance measurement for paid users

– Integrated retirement planning and advice features

– Personalized recommendations to help optimize finances and reach financial goals

Cons: A potential downside is Personal Capital mostly focuses on investment management for those with larger portfolios. The basic free version may not offer enough depth for some users.

Pricing: Personal Capital offers both free and paid subscription plans. The basic services are free, while premium features and services start at $40/month for enhanced reporting, trackers, planners and advisor access.

Some key stats about Personal Capital include:

– Over $15 billion in assets under management

– Provides services for both individual investors and financial advisors

– Integrations with over 3,000 financial institutions including banks, brokerages and 401(k) plans

11. Tradestation

TradeStation is one of the original and leading online brokerages for trading stocks, ETFs, options and futures. Founded in 1982, TradeStation has decades of experience in powering traders of all experience levels with sophisticated tools and technology. They provide a full-featured online trading platform as well as brokerage services at competitive commission rates.

Pros: Some of the key advantages of using TradeStation include: a powerful trading platform for advanced traders; customizable technical analysis tools and charts; portfolio replication and backtesting capabilities; robust screening and idea generation tools; low-cost direct access routing for professional traders.

Cons: The main potential disadvantage is the higher fees for less frequent traders compared to other discount brokers. The platform is also more advanced than needed for beginner investors.

Pricing: TradeStation offers several plan and pricing options starting from $0 per trade for stocks, ETFs and options, up to $9.95 per trade or $14.99 per trade for futures. There are also monthly platform fees ranging from $0-$24.95 depending on the plan. Data fees also apply for real-time market data subscriptions.

Some key stats about TradeStation include: supports over 80 global exchanges; average daily volume of over 2.5 million shares traded; more than $5 billion in assets under management; over 150,000 active funded accounts.

12. LearnVest

LearnVest is an online personal finance platform that provides budgeting, investment management and financial planning tools. Founded in 2009, LearnVest helps users take control of their finances through easy-to-use tools and personalized guidance from CFP professionals.

Pros: Some key advantages of LearnVest include:

– Comprehensive financial planning tools to simplify budgeting, saving, investing and long-term goals

– Personalized recommendations and guidance from certified financial planners (CFP)

– Community of users for continued learning and accountability

– Focus on education to give users autonomy over their finances

Cons: One potential disadvantage is that LearnVest’s paid subscription or ‘Premium’ tier is required to access the full suite of planning and advisory tools. The free basic level only includes limited budgeting and recommendations.

Pricing: LearnVest offers both free and paid subscription tiers. The free ‘Basic’ level provides basic budgeting and limited recommendations. For full access to advanced planning tools, account management and unlimited guidance from financial experts, pricing starts at $99 annually or $9.99 monthly for ‘Premium’ subscription.

Some key stats about LearnVest include:

– Over 1 million users

– Access to a community of over 80,000 financial coaches and advisors

– Customizable tools for budgeting, saving goals, retirement planning and more

– Integrations with over 15,000 financial institutions for account aggregation

13. Tiller Money

Tiller Money is a portfolio management and personal finance software that aims to make managing your investments simple and hassle-free. Founded in 2015, Tiller allows you to view all of your accounts, including brokerages, bank, and credit cards, in a single customizable spreadsheet. With Tiller, you can automatically track your net worth, balances, transactions, and investments in one convenient place.

Pros: Some key advantages of Tiller include:

– Built-in portfolio rebalancing and tax-loss harvesting to optimize taxes and returns.

– Automatic data aggregation that imports transactions, balances, and positions from all linked accounts.

– Customizable colored tabs and templates to view performance, holdings, and net worth over time.

Cons: A potential disadvantage is that Tiller is a software-as-a-service solution which requires a monthly/annual subscription fee starting at $12/month rather than being a one-time purchase.

Pricing: Tiller offers three pricing tiers:

– Basic: Free, allows linking of one brokerage account.

– Standard: $12/month, adds unlimited accounts and advanced reporting.

– Premium: $25/month, adds partner integrations and priority support.

Some key stats about Tiller include:

– Manages over $5 billion in assets for both individual investors and financial advisors.

– Linked to over 500 funding sources including all major brokerages like Fidelity, Schwab, and E-Trade.

– Used by over 40,000 investors and has a 4.8/5 star rating across 4,000+ reviews on the Chrome Web Store.

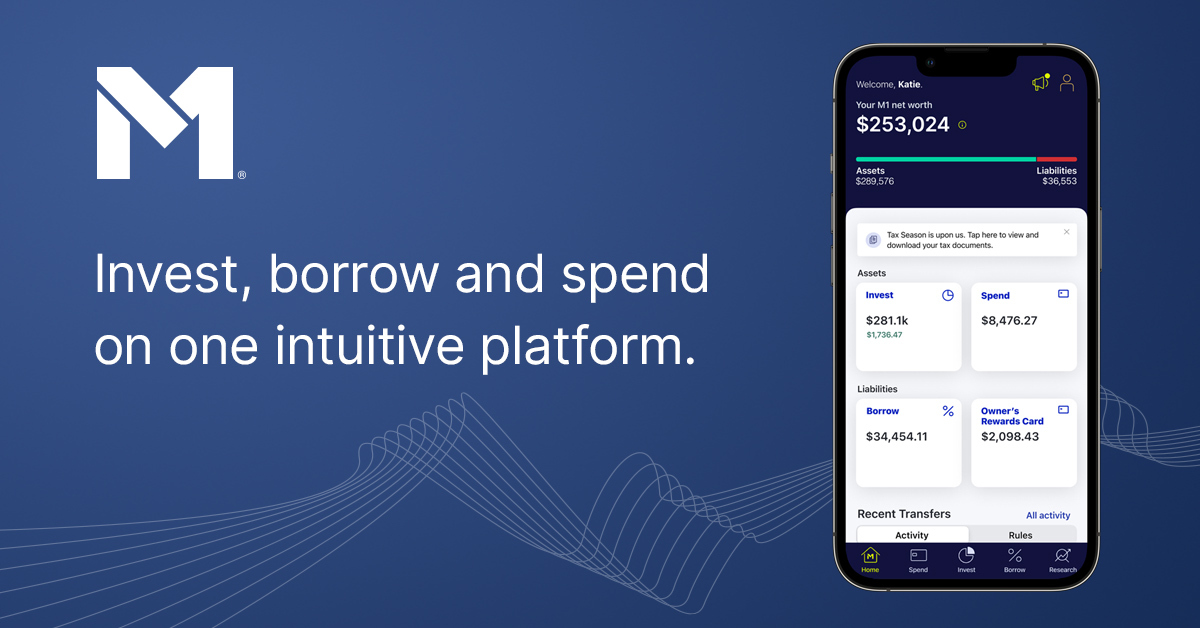

14. M1 Finance

M1 Finance is an automated investing platform that allows users to build custom portfolios consisting of ETFs and stocks. Founded in 2015, M1 aims to make investing more accessible through features like fractional share purchases and automatic rebalancing. With M1, users can build custom investment pies of ETFs and stocks and have their money automatically allocated and rebalanced according to their personal asset allocation.

Pros: Some key advantages of M1 Finance include:

– Allows fractional shares so you can build portfolios with ETFs and stocks regardless of share price

– Automated rebalancing and tax-loss harvesting helps maintain target asset allocation over time

– Offers custodial accounts like IRAs and trusts

– intuitive interface makes investing and account management simple

Cons: One potential disadvantage is M1 Finance’s offerings are limited to ETFs and stocks only. Investors wanting active portfolio management or investment options like bonds and mutual funds may find the platform too restrictive.

Pricing: M1 Finance offers three plans – Basic (free), Plus ($125/year), and Pro ($250/year). The Plus and Pro plans provide additional features like higher cash management rates, extended hours trading, and improved customer support.

Some key stats about M1 Finance include:

– Over $5 billion in assets under management

– Over 1 million users

– Offers over 150 ETFs and 1200+ stocks to choose from for custom portfolios

– Popular with novice investors as there are no account minimums or trading fees

Conclusion

Whether you’re a seasoned investor or just getting started, having the right investment tracking and portfolio management tools can make a big difference in achieving your long-term financial goals. The top solutions highlighted in this post represent some of the best options for effortlessly managing your portfolio while keeping costs low. Do your research and consider trialing a few platforms to find the one that aligns best with your investment approach, needs and budget.