Introduction

Managing cash flow is one of the biggest challenges that small businesses face. Having visibility into cash inflows and outflows is key to making strategic financial decisions and avoiding cash flow problems. In this post, we evaluate the top 15 cash flow management software options based on features, pricing, ease of use and other factors to help you find the right solution for your business needs in 2023.

Methods of Evaluation

We evaluated each software based on features for cash flow management, forecasting and reporting abilities, pricing options, ease of use and onboarding process. Additional factors like customer support, integrated accounting features and mobile accessibility were also considered. Beyond conventional evaluation, we also looked at number of backlinks, average monthly traffic and keyword trend to help rank the companies.

1. QuickBooks

QuickBooks is an accounting software developed and marketed by Intuit. With over 4 million customers, QuickBooks is one of the leading cash flow management software solutions for small businesses. It offers an all-in-one solution for invoicing, bookkeeping, payroll and more.

Pros: Key advantages of QuickBooks include:

– Easy accounting and invoicing

– Budgeting and income forecasting

– Integrated bank feeds for automatic reconciliation

– Payment tracking and reminder features

– Integrated payroll processing

Cons: A potential disadvantage is the subscription-based pricing model which requires recurring payments versus a one-time purchase license.

Pricing: QuickBooks offers various pricing tiers starting from $15/month for the self-employed version to $45/month for the more full-featured Accountant version. Additional fees apply for added services like payroll processing.

Some key stats about QuickBooks include:

– Over 4 million customers worldwide

– Integrations with over 6000 banking institutions

– Covers 80% of small business accounting needs

– Real-time bank feeds for automatic transaction imports

2. Xero

Xero is an online accounting software for small businesses. Founded in 2006, Xero provides an integrated platform for managing finances, accounting, invoicing and payments. With over 3 million subscribers globally, Xero aims to make financial management easier for entrepreneurs and their advisors.

Pros: Some key advantages of Xero include:

– Integrated accounting platform that connects banking, billing and bookkeeping

– Advanced budgeting and forecasting tools to plan cash flow

– Real-time dashboards and reports to track business performance

– Mobile app for managing finances on the go

Cons: A potential disadvantage is the monthly subscription fee which can be a recurring business cost, though the all-in-one platform aims to provide value for this investment.

Pricing: Xero offers various pricing plans starting from $9-50/month depending on the number of users and features required. All plans are sold via monthly subscription. Additional costs may apply for integrations with third party applications and services.

Some key stats about Xero include:

– Over 3 million subscribers worldwide

– Integrates with over 800 apps including banks, POS systems and CRM tools

– Real-time dashboards and reports to track cash flow, income and expenses

– Advanced budgeting and forecasting features

3. Venmo

Venmo is a digital wallet and online payment service owned by PayPal. Launched in 2009, Venmo allows users to easily send and receive money between friends and family members using a mobile phone app. Over 60 million people now use Venmo to share payments for everything from splitting group dinners to paying rent. Venmo remains one of the most popular peer-to-peer payment apps in the United States.

Pros: Some key advantages of using Venmo include:

– Simple and easy to use mobile app interface

– Free to send and receive funds between friends

– Ability to split shared expenses and bills across multiple people

– Social features allow for commenting on payments

– Widespread app acceptance and usage amongst social networks

Cons: One potential disadvantage of Venmo is that payments are not as secure as traditional bank transfers or credit cards, as funds are transferred between individual accounts rather than merchant payment processors. This makes personal payments via Venmo a potential target for fraudsters.

Pricing: Venmo’s basic services of sending and receiving funds between individuals is completely free. There are no fees associated with typical personal use. However, Venmo does charge fees for certain business or merchant transactions processed through the app.

Some key stats about Venmo include:

– Over 60 million active users as of 2022

– Processed over $260 billion in total payment volume in 2021

– Average user is between 25-40 years old

– Most popular payment method amongst millennials

4. FreshBooks

FreshBooks is an online accounting and invoicing software designed for small businesses and freelancers. Founded in 2003 and headquartered in Toronto, Canada, FreshBooks helps over 30,000 companies manage their finances through its easy-to-use online platform.

Pros: Some key advantages of FreshBooks include:

– Easy to use invoicing and time tracking app

– Bank feeds for importing transactions automatically

– Robust reporting and analytics for insights into business performance

– Expense management for tracking reimbursable client costs

Cons: A potential disadvantage is that the features are more limited compared to full-fledged accounting software like QuickBooks. It may not be suitable for very large or complex businesses.

Pricing: FreshBooks offers three pricing tiers:

– Solo Plan: $15/month billed annually for up to 3 clients

-Freelance Plan: $25/month billed annually for up to 10 clients

-Business Plan: $49/month billed annually for unlimited clients

Some key stats about FreshBooks include:

– Used by over 30,000 companies globally

– Processes over $30 billion in invoices annually

– Offers native mobile apps for iOS and Android

– Integrates with over 200 third-party apps including QuickBooks, Xero, and PayPal

5. Palm

Palm is cloud-based cash flow management software that helps businesses and individuals track expenses, forecast cash flow, and generate insightful reports. Founded in 2018, Palm integrates directly with major banks and credit cards to automatically import transactions for effortless expense tracking.

Pros: Some key advantages of Palm include:

– Automated expense tracking from banking integrations saves time.

– Simple yet powerful cash flow forecasting helps plan for upcoming expenses.

– Powerful reporting on purchases and expenses provides insights for spending habits.

Cons: A potential disadvantage is that Palm is subscription-based software so there is an ongoing cost to use the platform compared to one-time purchase software.

Pricing: Palm offers 3 pricing tiers:

– Basic plan starts at $9/month for 1 user.

– Pro plan starts at $29/month for 3 users.

– Business plan starts at $99/month for 10 users.

Some key stats about Palm include:

– Over 10,000 businesses and individuals currently use Palm.

– Palm integrates with over 10,000 banks and credit cards worldwide.

– Palm forecasts cash flow 30 days into the future and updates forecasts weekly based on actual spending data.

– Users can generate over 50 pre-built reports on cash flow, expenses, and purchasing habits.

6. Wave

Wave is a free and easy to use accounting software for small businesses. Founded in 2003 and based in Toronto, Canada, Wave provides small businesses with free accounting software as well as additional premium services like credit card processing and payroll. The software helps small businesses manage finances, send invoices, track expenses and get paid.

Pros: Some key advantages of using Wave include:

– Free basic accounting software for up to 10 invoices per month

– Intuitive and easy to use interface

– Accept payments online and seamlessly reconcile them to invoices

– Basic cash flow forecasting and budgeting tools included

– Premium services like payroll and advanced reporting available for a low monthly fee

Cons: One potential disadvantage is that the free version has limited functionality with caps on the number of invoices that can be created each month. For more advanced accounting needs, a paid plan may be required.

Pricing: Wave offers the following pricing plans:

– Free Plan: Allows up to 10 invoices/month. No transaction fees.

– Plus Plan: $30/month. Unlimited invoices. 1.95% + $0.30 per credit card transaction.

– Premium Plan: $50/month. All Plus features plus advanced reporting and payroll.

Some key stats about Wave include:

– Over 3 million users worldwide

– Processes over $10 billion in transactions annually

– Accepts credit card, bank transfer and PayPal payments

– Integrates with over 35 banking institutions

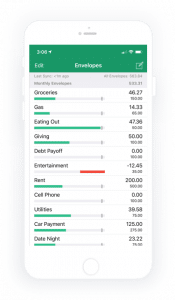

7. You Need A Budget (YNAB)

You Need A Budget, commonly known as YNAB, is a subscription-based budgeting and personal finance software developed by Jesse Mecham. YNAB helps users break the paycheck-to-paycheck cycle and get their financial lives on track using a revolutionary method called ‘Zero-Based Budgeting’.

Pros: Some key advantages of YNAB include: – Zero-based budgeting promotes savings by allocating each dollar to a specific purpose – Available on desktop and mobile apps for on-the-go access to finances – Multiple reports provide insights into spending habits to help curb unnecessary expenses

Cons: The subscription fee could be a disadvantage for some compared to free budgeting apps and spreadsheets.

Pricing: YNAB offers a 34 day free trial and then plans start at $84 per year for individuals or $99 per year for families. Students get 50% off and there are often special promotional rates available.

Some key stats about YNAB include: – Used by over 2 million users worldwide – Average user saves over $600 in the first two months – 90 day free trial available for new users – Wins numerous awards and accolades for budgeting and finance category.

8. Avalara

Avalara is a leading provider of automated tax compliance software. Founded in 1998, Avalara helps businesses of all sizes manage tax compliance. With Avalara, businesses can automate key processes like sales tax calculation, filing and payment with seamless integration into existing systems like ERPs and eCommerce platforms.

Pros: Some key advantages of using Avalara include:

– Automated sales tax calculation and filing for fast and accurate compliance

– Integrates seamlessly into existing workflows for a seamless experience

– Covers a wide range of tax types beyond just sales tax like VAT/GST

– Robust support and continuous updates to stay up to date with changing rules

Cons: The main disadvantage is the cost – Avalara has pricing tiers based on transaction volume so it may not be suitable for very small businesses or those with low transaction volumes.

Pricing: Avalara has different pricing tiers based on annual transaction volume:

– $49/month for up to $100k in transactions

– $99/month for up to $250k in transactions

– Custom pricing for larger businesses

Some key stats about Avalara:

– They have over 10,000 customers worldwide across various industries

– Processes over $100 billion in transactions annually

– Covers sales tax rules in over 11,500 jurisdictions in the US

– Integrations available with major eCommerce and accounting platforms

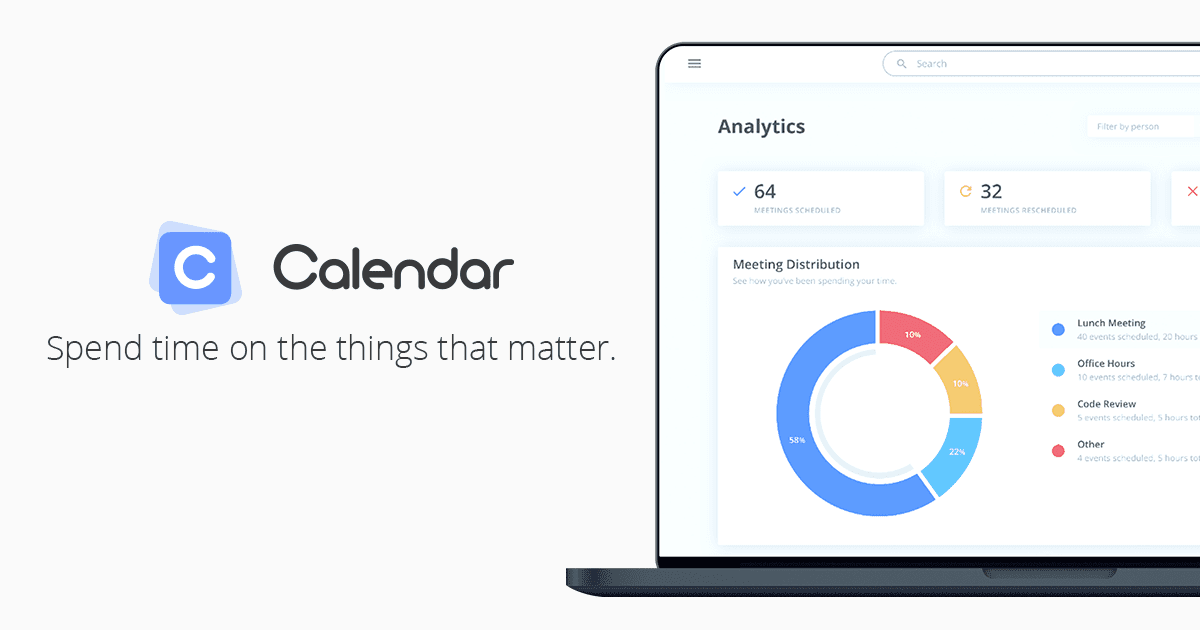

9. Calendar

Calendar is an online calendar and team scheduling software that provides cash flow management capabilities. Founded in 2005 and based in San Francisco, Calendar helps organizations manage scheduling, invoicing and payments all in one place.

Pros: Some key advantages of Calendar’s cash flow management features include: accounting, CRM and marketing automation capabilities integrated into one platform, robust cash flow forecasting and analytics to aid long-term planning, and bank feeds and automated bank reconciliation to streamline important financial tasks.

Cons: A potential disadvantage is that Calendar is more of a full-featured ERP/CRM platform and its cash flow management capabilities may not be as robust as other dedicated cash flow forecasting software options.

Pricing: Calendar offers both free and paid plans for its cash flow management software. The free Basic plan includes basic scheduling features. Premium plans start at $8/user/month for the “Team” plan and scale up to customized Enterprise plans for larger organizations.

Some key stats about Calendar’s cash flow management capabilities include robust forecasting tools that allow users to project cash inflows and outflows for up to 12 months in advance. The software also offers bank feed integration and automated bank reconciliation to track the real-time status of accounts.

10. Personal Capital

Personal Capital is a comprehensive wealth management platform that provides both consumer-friendly financial tools and professional wealth management services. Founded in 2009 and headquartered in San Carlos, CA, Personal Capital helps users take control of their financial lives through personalized guidance, analysis, and planning.

Pros: Some key advantages of Personal Capital include:

– Holistic wealth management platform that provides investment management, financial planning, and reporting all in one place

– Advanced financial planning tools for net worth, asset allocation, and performance tracking

– Robust reporting capabilities including personalized dashboards and graphs of accounts, balances, and projections

– Professional investment advisors available for users who want help managing their portfolios

Cons: One potential disadvantage is that while the basic financial tools are free, there is a fee (usually 0.95% of assets managed annually) for accessing the professional advice and wealth management services.

Pricing: Personal Capital offers both free and paid subscription options:

– Basic financial tools like net worth tracking, budgeting, and portfolio performance are free to use

– Access to their professional investment advisors and managed account services starts at 0.95% of assets under management annually

Some key stats about Personal Capital include:

– Over 4 million users of their free financial tools

– $15 billion in total client assets under management

– Consistently top rated on the Apple App Store for Personal Finance apps

– Offers both do-it-yourself financial tools and professional investment advisory services

11. FreeAgent

FreeAgent is an accounting and cash flow management software aimed at small businesses in the UK. In business since 2006, FreeAgent provides a simple yet powerful solution for accounting, billing, expenses and cash flow visibility.

Pros: Some key advantages of FreeAgent include:

– Very robust cash flow management features like cash flow forecasting

– Integration with popular third party apps for billing, payments and expenses

– Affordable pricing starting from £12/month for sole traders and freelancers

Cons: A potential disadvantage is that FreeAgent is aimed primarily at UK-based businesses, so may not support some needs of international customers.

Pricing: FreeAgent offers three pricing tiers:

– Solo Plan: £12/month for sole traders and freelancers

– Startup Plan: £24/month for up to 3 users

– Business Plan: £48/month for unlimited users

Some key stats about FreeAgent include:

– Over 60,000 businesses trust FreeAgent to manage their finances

– Integrations with over 50+ popular apps such as Xero, Stripe and PayPal

– 99.9% uptime guaranteed

– 30 day money back guarantee

12. Deputy

Deputy is employee scheduling, timesheet, and time clock software that helps companies track staff costs and productivity. Founded in 2012, Deputy is based in Melbourne, Australia and serves over 20,000 customers globally across various industries like retail, hospitality, health, and more.

Pros: Some key advantages of Deputy include:

– Tracks staff costs and productivity to help improve cash flow management

– Integrates with payroll and invoicing systems for a streamlined process

– Easy-to-use interface for creating schedules and tracking timesheets

Cons: A potential disadvantage is that the free version only supports one user and up to 5 active employees. For larger teams, businesses would need to upgrade to a paid plan.

Pricing: Pricing starts from $15/month for the Essential plan for up to 10 employees. The Standard plan is $39/month for up to 25 employees. Custom enterprise plans are also available for large businesses with over 25 employees.

Key features of Deputy include time and attendance tracking with cash flow management tools. It integrates with popular payroll and invoicing systems like Xero, MYOB, and Hubstaff. Deputy claims to help businesses save over 30 hours per week on scheduling and administrative tasks.

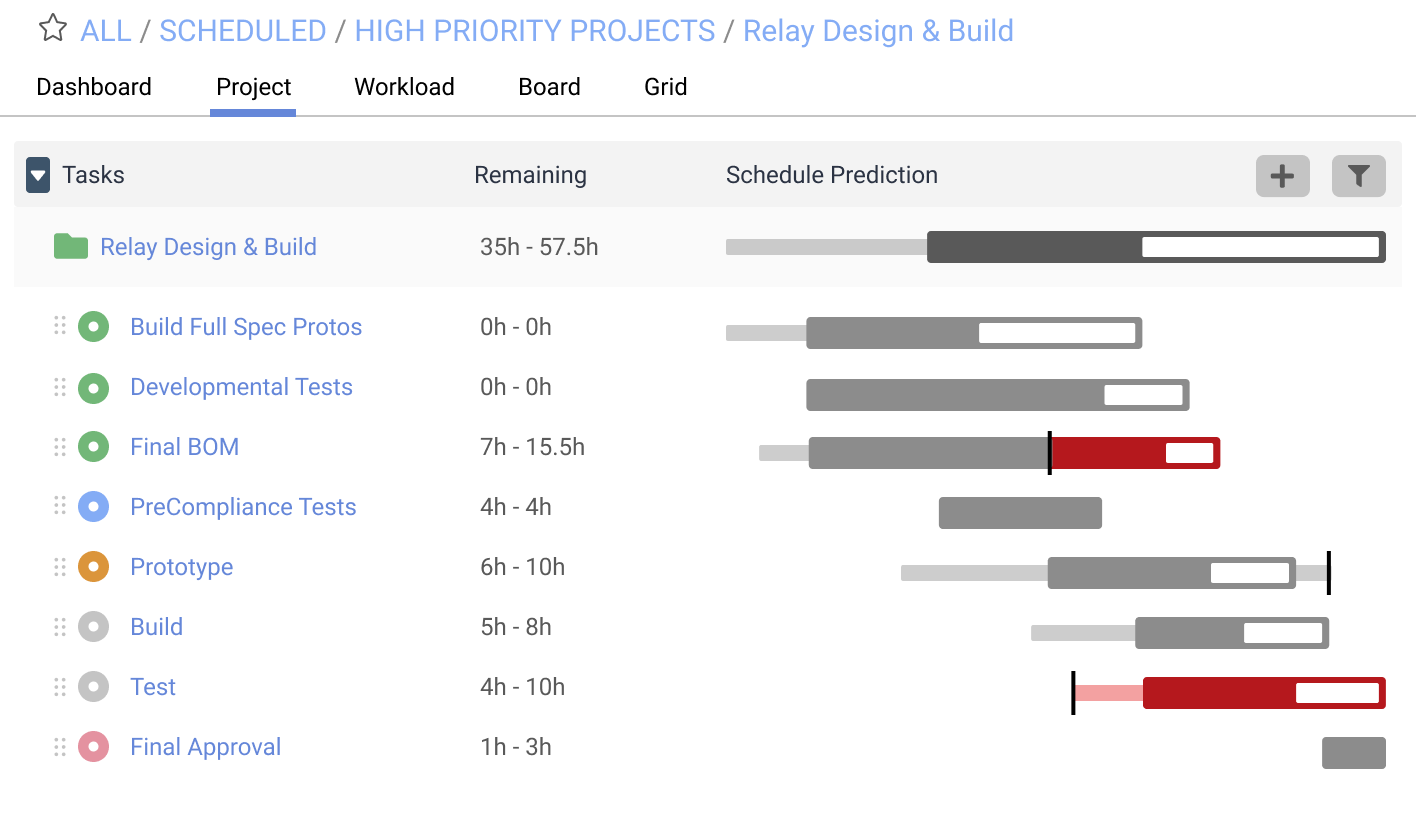

13. LiquidPlanner

LiquidPlanner is a cash flow management software that aims to help teams plan, predict, and perform through predictive scheduling. Founded in 2013, LiquidPlanner is headquartered in Seattle, Washington and offers a cloud-based project management solution.

Pros: Some key advantages of LiquidPlanner include:

– Advanced financial modeling tools to forecast cash flow and budgets

– Customizable financial reporting dashboards to track key metrics

– Cash flow scenario modeling to compare different what-if scenarios and plan for uncertainties

Cons: A potential disadvantage is that the predictive scheduling requires manual input of tasks, resources and deadlines at first to provide enough data for the system to learn workload patterns.

Pricing: LiquidPlanner offers different pricing plans depending on team size starting from $49 per month for the Lite plan for up to 3 users and going up to customized Enterprise plans for large organizations.

Some key stats about LiquidPlanner include:

– Used by over 5,000 companies worldwide including Microsoft, T-Mobile, and Anthropic

– Predictive scheduling engine accurately predicts workload 95% of the time

– Handles projects of all sizes from small teams to Enterprise organizations

14. GoodBudget

GoodBudget is a budgeting and cash flow management software that helps users budget according to their goals and priorities. Founded in 2010, GoodBudget makes it easy to track spending, create and share budgets, and stay on top of your cash flow. With automatic bank syncing and insightful dashboards, GoodBudget helps users spend responsibly and save towards what matters most.

Pros: Some key advantages of GoodBudget include:

– Focus on budgeting according to goals and priorities rather than just categories

– Robust yet intuitive cash flow focused dashboards

– Automatic bank imports for effortless transaction tracking

– Built-in budget templates for various needs like saving goals

– Ability to share budgets and track spending with others

Cons: One potential disadvantage is that the free version only allows importing transactions from one bank account. Advanced functionality requires a paid subscription.

Pricing: GoodBudget offers a free basic version as well as paid premium plans starting at $5.83/month (billed annually) for an individual plan or $8.33/month for a family plan.

Some key stats about GoodBudget include:

– Over 2 million users

– Automatic syncing with over 9,000 banks and credit unions worldwide

– Available on all platforms including web, iOS, and Android

15. EveryDollar

EveryDollar is a cash flow management software created by Dave Ramsey Solutions. It helps users budget, track spending, and gain insights into their financial habits using a zero-based budgeting method where all funds are allocated to specific items each month.

Pros: The main advantages of EveryDollar include its zero-based budgeting approach which forces users to account for all their income each month, its automatic transaction categorization which makes tracking spending easy, and its simple and effective cash flow focused tools which help users gain control over their finances.

Cons: A potential disadvantage is that the automatic transaction categorization does not work perfectly and users may need to manually correct some miscategorized transactions periodically.

Pricing: EveryDollar offers a free version with limited functionality as well as paid subscription plans starting at $99.99 per year which unlock additional budgeting, reporting and cash flow tools.

Some key stats about EveryDollar include: it has over 1 million active users, transactions are automatically categorized when imported from bank accounts, and it focuses on building a spending plan that allows users to save and avoid debt.

Conclusion

Every business has unique cash flow management needs. Use this evaluation to shortlist some options that best suit your requirements. Evaluate free trials thoroughly to understand intricacies before committing to a paid plan. Proper cash flow visibility can help you make informed financial decisions and keep your business running smoothly. Choose wisely and streamline your cash flow management process starting today.