Introduction

Managing personal finances is an important part of maintaining financial wellness. Whether you’re looking to budget, track spending, organize bills or do more advanced accounting, there are many free software options that can help. In this post, we will review 15 of the most popular and effective free personal finance apps for both basic money management needs as well as more advanced uses.

Methods of Evaluation

To evaluate and rank the top free personal finance software, we considered several factors including features, ease of use, popularity, customer reviews and ratings. Additional criteria like number of monthly active users, backlinks to the company website, traffic trends and keyword volume were also analyzed to gauge real-world engagement and demand. The following reviews are ordered based on overall effectiveness determined by these conventional evaluation methods as well as digital metrics.

1. HomeBank

HomeBank is a free, open-source personal finance management software for tracking income, expenses and budgets. It has been in development since 2001 and is available for Windows, Linux and Mac. HomeBank allows users to manage all their finances in one place by importing transaction data from banks and credit cards.

Pros: The main advantages of using HomeBank include:

– Free to use without any subscription fees or hidden costs.

– Cross platform support for Windows, Linux and Mac.

– Open source development model ensures longevity and community support.

– Customizable reports, budgets and visualizations for deeper insights.

Cons: One potential disadvantage is that HomeBank is not a web or mobile based application. Therefore, users need to have the software installed on their computer to access and manage their finances instead of having a SaaS solution.

Pricing: HomeBank is completely free to download and use without any limitations. Since it is open source, there are also no subscription or upgrade costs associated with using the software.

Some key stats and capabilities of HomeBank include:

– Works with many common bank data formats like OFX, QIF, CSV and MT940 formats for easy import of transactions.

– Provides visual graphs and charts for budgets, trends and reports on spending categories.

– Allows tracking of investments, assets and liabilities with adjustable accounts.

– Completely free and open source software without any costs or limitations.

2. Wells Fargo Budget Coach

Wells Fargo Budget Coach is a free personal finance software offered by Wells Fargo bank. As a Wells Fargo customer, you can easily import your transaction data from your linked Wells Fargo accounts to track spending and stay on top of your budget. The tool provides basic yet useful budgeting and financial management features without any sort of subscription fees.

Pros: Key advantages of Wells Fargo Budget Coach include: – Free budget tool from a major bank – Imports Wells Fargo transaction data automatically without manual entry – Basic yet useful budgeting and spending analysis tools to stay on track financially

Cons: The main disadvantage is that as a free tool, Wells Fargo Budget Coach only provides basic budgeting functionality without advanced features. Premium paid personal finance software may offer more robust tracking, budgeting, and reporting features.

Pricing: Wells Fargo Budget Coach is completely free to use for all Wells Fargo customers. There are no subscription fees or in-app purchases required to access all core functionality of tracking spending, creating and managing budgets, and viewing reports.

Some key features of Wells Fargo Budget Coach include the ability to import transaction data from linked Wells Fargo accounts, categorize spending automatically, track budget vs. actual spending, and get spending notifications. The tool works across desktop and mobile browsers for easy access anytime, anywhere.

3. Wave Financial

Wave Financial is a free financial management software for small businesses and individuals. Founded in 2003 and headquartered in Canada, Wave provides a suite of free accounting, invoicing and payment processing tools on its website and mobile apps.

Pros: Some key advantages of Wave include:

– It’s free for basic use, saving small businesses accounting costs

– Easy to use interface that streamlines billing, expenses and banking

– Accepts credit card payments directly through their platform

– Integrates with over 150 banking institutions to simplify transactions

Cons: The main disadvantage is that it only provides basic functionality for free. For more advanced features like expense tracking or custom fields, paid plans are required starting at $15/month.

Pricing: Wave offers the following pricing plans:

– Free Plan – Suitable for sole proprietors and micro-businesses. Provides basic invoicing and accounting.

– Plus Plan – $15/month. Adds expense tracking, time tracking and importing.

– Premium Plan – $40/month. For larger teams with advanced reporting and customized receipts.

Some key stats about Wave include:

– Used by over 4 million small businesses in over 130 countries worldwide

– Processes over $5 billion in annual payments

– Offers free accounting, invoicing and bank syncing capabilities

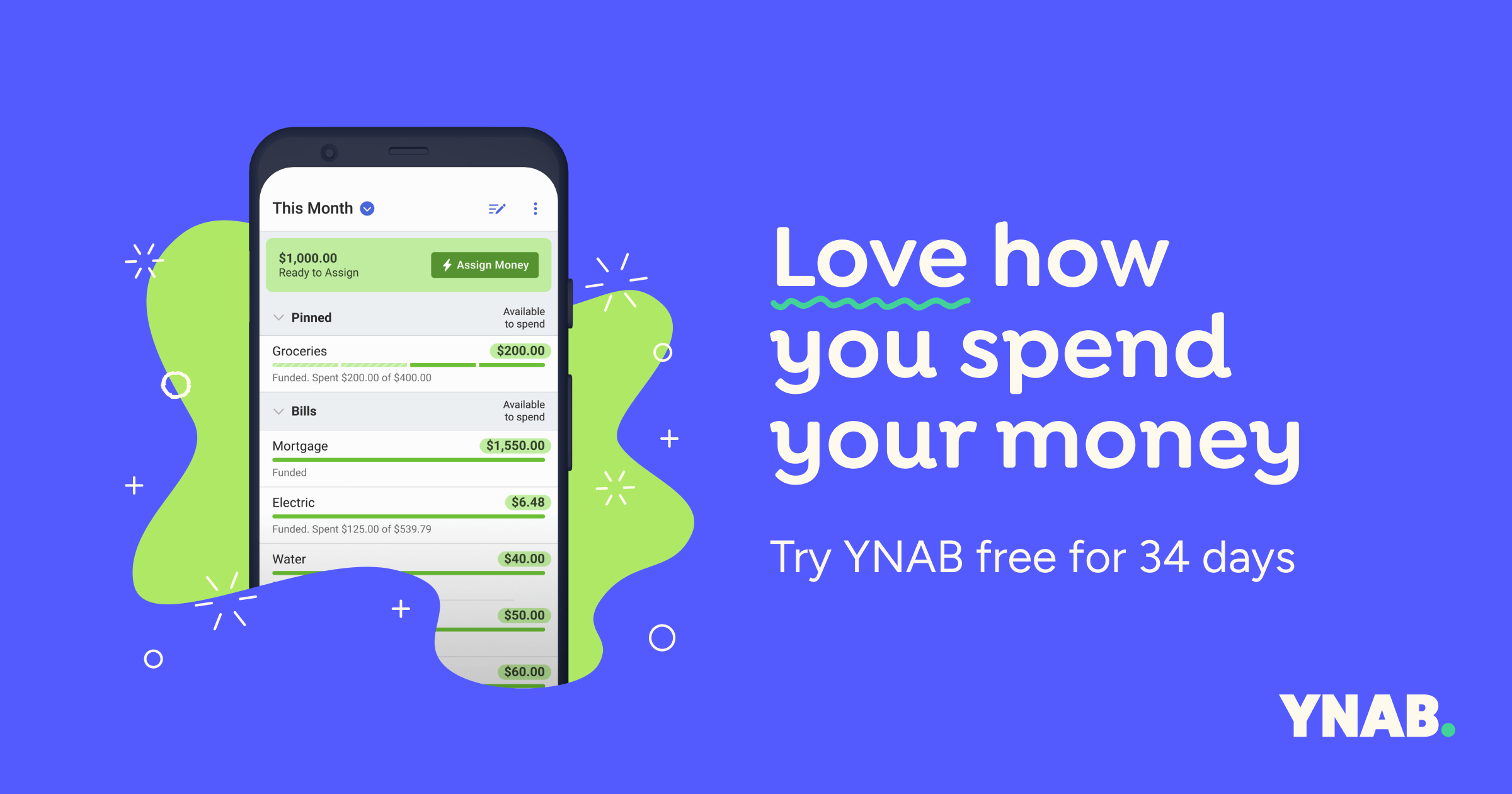

4. You Need a Budget (YNAB)

You Need a Budget (YNAB) is a personal finance software that helps users gain control of their finances through a method of budgeting and tracking spending called the “Rule of 50/30/20”. Founded in 2004, YNAB has grown to support over 2 million subscribers worldwide.

Pros: Key advantages of YNAB include:

– Focus on giving every dollar a job with the Rule of 50/30/20 budget method

– Monthly subscription but offers a 34-day free trial to try it out

– Mobile app for easy access to check budgets and expenses on the go from any device

Cons: The key disadvantage is that YNAB uses a subscription model rather than a one-time purchase. This means users must pay monthly or annually to continue using the software.

Pricing: YNAB offers two main pricing tiers:

– Monthly subscription for $84 per year billed annually

– Student pricing at $45 per year for verified students

Some key stats about YNAB include:

– Supports over 2 million subscribers globally

– Offers comprehensive budgeting and expense tracking across multiple accounts and categories

– Mobile apps available for iOS and Android for easy access to finances anywhere

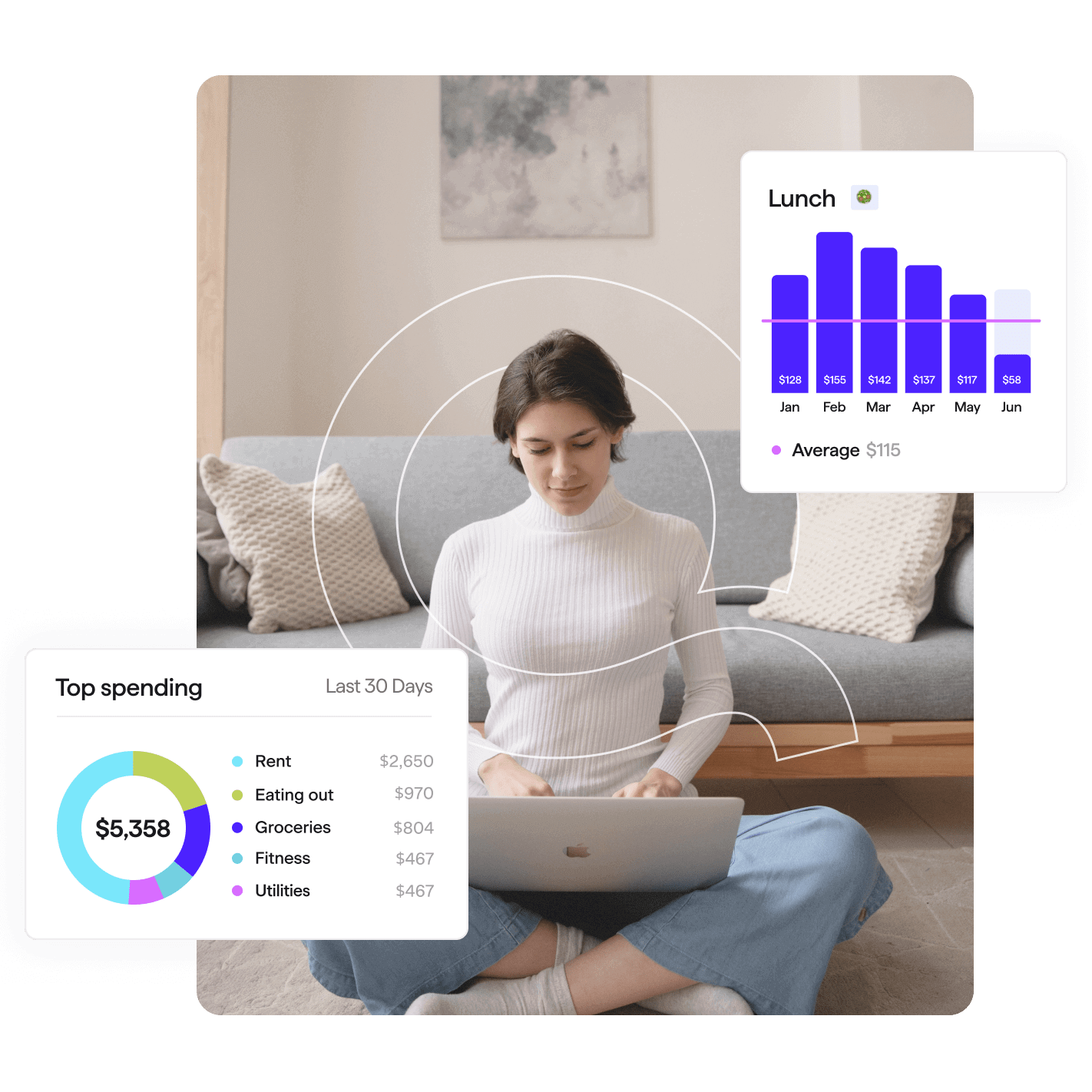

5. You Need a Budget (YNAB)

You Need a Budget (YNAB) is a popular personal finance software that takes a different approach to budgeting. Rather than tracking where your money has gone, YNAB focuses on planning where every dollar needs to go in the future. This method of giving every dollar a specific “job” is meant to help users spend mindfully and save easily.

Pros: Key advantages of YNAB include:

– Its envelope budgeting method of allocating funds helps avoid overspending

– Color-coded categories in the interface make overspending obvious at a glance

– Robust mobile apps allow seamless money management on the go

– Bulk transaction entry for linking accounts eases setup and tracking

Cons: The only real disadvantage is that YNAB requires a monthly subscription fee after the initial 34-day trial. While very reasonably priced starting at $84 annually, it is not a free option for budgeting software.

Pricing: YNAB offers three pricing plans:

– Classic Plan: $84/year or $11.99/month

– Premium Plan: $99.99/year or $14.99/month (adds reports and graphs)

– Teams Plan: $12.50/user/month (collaboration tools for organizations)

Some key stats about YNAB include:

– Over 2 million users worldwide

– Average user saves over $600 in the first year

– 34-day trial period for the web-based software

– Mobile apps available for iOS and Android devices

6. Ms. Money

Ms. Money, also known as Quicken, is a freeware personal finance software developed by Intuit. Quicken has been helping users track their finances for over 30 years and is one of the most popular personal finance managers available.

Pros: Some key advantages of Ms. Money include:

– It’s completely free to use with no subscriptions or in-app purchases required

– Easy to use interface that’s intuitive for beginners but powerful for advanced users

– Automatically syncs transactions between devices via online account access

– Generates helpful guidance and recommendations tailored to your unique financial situation

Cons: One potential disadvantage is that the free version has limited reporting capabilities compared to the paid versions. Advanced reports and analysis require an upgrade to one of the premium paid plans.

Pricing: Ms. Money has a freemium pricing model. The basic software is free to download and use indefinitely. For access to more advanced features like investments tracking, bills payment, budgeting tools etc. upgrades to one of the paid Quicken plans starting from $59.99 per year are required.

Some key stats about Ms. Money include:

– Over 10 million downloads worldwide

– Tracks income, expenses, credit cards, investments and more for a complete picture of finances

– Generates detailed reports on cash flow, budgets, net worth and more to stay on top of your money

7. GnuCash

GnuCash is an open-source personal and small business finance software application. It is free accounting software for Windows, Linux and MacOS that allows users to track income, expenses and banking across multiple accounts and currencies.

Pros: Some key advantages of GnuCash include:

– Open-source and free to use with no restrictions

– Cross-platform support for Windows, Linux and MacOS

– Double-entry accounting ensures accurate bookkeeping

– Import support for popular file formats streamlines data entry

Cons: One potential disadvantage is that as open-source software, it may not receive customer support like paid alternatives. The user interface also takes some getting used to for those familiar with other accounting software.

Pricing: GnuCash is completely free to download and use without limitations. There are no premium paid tiers or in-app purchases. Users can benefit from all of its features without any costs.

Some key features and stats of GnuCash include:

– Open-source double-entry accounting software that is freely downloadable

– Allows tracking of income, expenses and banking across multiple accounts and currencies

– Supports importing transactions via OFX, QIF and CSV file formats

8. Personal Capital

Personal Capital is a personal finance software that offers free financial management tools as well as paid wealth management services. Founded in 2009 and headquartered in San Francisco, Personal Capital helps users take control of their finances with its free financial dashboard that aggregates all your accounts in one place.

Pros: Some of the key advantages of Personal Capital include:

– Free financial snapshot that pulls in data from all your bank, investment, loan, and credit card accounts

– Advanced investment portfolio analysis and personalized advice

– Access to professional financial planners and wealth management services for a fee

Cons: A potential disadvantage is that the wealth management services provided by Personal Capital for a fee may not be affordable for all users considering it requires a minimum balance of $100,000.

Pricing: Personal Capital offers its basic financial management tools for free. For access to its full-service wealth management, you need to open an account with a minimum balance of $100,000. It charges an ongoing fee of 0.89% of assets per year for its wealth management services.

Some key stats about Personal Capital include:

– Over $15 billion in assets under management

– Serves over 1 million users

– Ranks as one of the top financial planning websites

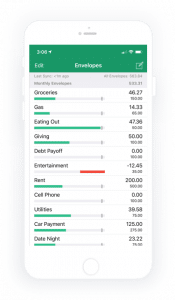

9. GoodBudget

GoodBudget is a free budget tracking app that helps users gain control over their finances. Founded in 2011 and based in Seattle, Washington, GoodBudget uses a goal-based approach to budgeting to help users align their spending with their values.

Pros: Some key advantages of GoodBudget include:

– Basic budgeting features are free to use forever

– Easy setup and use via intuitive app interface

– Goals-based approach helps users motivate spending aligned with priorities

– Premium subscription unlocks additional reports and budgeting tools

Cons: A potential disadvantage is that the free version has limited functionality compared to the paid premium subscription. Advanced reporting, budgeting categories and features require upgrading to the premium plan.

Pricing: GoodBudget has the following pricing plans:

– Free forever basic tracking

– Premium personal plan: $5.83/month or $59.99 annually

– Premium family plan: $8.33/month or $83.99 annually

Some key stats about GoodBudget include:

– Over 1 million users

– Available on web, iOS, and Android

– Integrates with over 3000 banks and credit cards for automatic transaction syncing

– Supports multi-user budgets to track household finances

10. EveryDollar

EveryDollar is a personal finance budgeting app developed by Dave Ramsey Solutions. It utilizes Dave Ramsey’s baby step approach to budgeting where users allocate every dollar of their income to specific financial categories like housing, food, transportation, etc. This zero-based budgeting methodology ensures users spend and save money purposefully.

Pros: Key advantages of EveryDollar include:

– It’s free to use indefinitely which makes budgeting very accessible

– Automatic transaction syncing saves a lot of manual data entry time

– Colorful reporting and graphs make understanding spending behaviors very visual and easy to track

Cons: A potential disadvantage is that as a free product, support and features may be more limited compared to paid budgeting apps.

Pricing: EveryDollar has a free version supported by advertisements. There is also a premium ‘EveryDollar Plus’ subscription starting at $9.99/month which removes ads and provides additional advanced budgeting tools and reporting.

Some key stats and features of EveryDollar include:

– Used by over 1 million households to manage finances

– Links directly to bank accounts to automatically categorize transactions

– Provides colorful pie chart showing budget vs actual spending each month

11. PocketGuard

PocketGuard is a free personal finance management software that helps users take control of their finances. The app allows users to organize their bills, track expenses, and plan budgets in an easy-to-use interface.

Pros: Some key advantages of PocketGuard include:

– Intuitive budgeting tools to help users spend less

– Ability to import transactions from banks and credit cards to track spending progress

– Alerts users when they are approaching set spending limits on different budget categories

Cons: A potential disadvantage is that PocketGuard is only available as a mobile app, so desktop access is not possible.

Pricing: PocketGuard has a free version that is supported by ads. For an ad-free experience, annual subscriptions start at $36 per year or $3 per month.

Some key stats about PocketGuard include:

– Over 5 million downloads on Android and iOS stores

– Used in over 100 countries globally

– Helps users track over $5 billion in transactions each year

12. bills.com

Bills.com is a personal finance software provided by Anthropic to help users organize and automate their bill payments. The service is free to use for basic functionality, with premium paid tiers that unlock additional features.

Pros: Some key advantages of Bills.com include:

– Free basic service with no subscriptions required

– Intuitive interface that makes bill payment simple

– Automatic payment reminders help you avoid late fees

– Insights into spending habits to help track your finances

Cons: One potential disadvantage is that the premium paid tiers may be unnecessary for users with basic bill payment needs.

Pricing: Bills.com offers a free basic service. Paid premium plans start at $4.99/month or $49.99/year and provide additional features like advanced financial tracking, budgeting tools and credit score monitoring.

Some key stats about Bills.com include:

– Over 10 million users

– Automatic payment tracking and scheduling for hundreds of bills and accounts

– Integrations with all major banks and credit cards for easy payment processing

13. Tiller

Tiller is a free personal finance and accounting software that allows you to track your personal finances and small business expenses in a spreadsheet. Founded in 2016, Tiller aims to make accounting easier and more accessible for individuals and small businesses through an intuitive spreadsheet interface.

Pros: Some of the key advantages of Tiller include:

– Intuitive spreadsheet interface that is familiar to most users

– Free tier that allows tracking of unlimited personal finances

– Built-in templates for common accounting tasks like invoicing

– Automatic transaction import from linked bank accounts

Cons: One potential disadvantage is that as a web-based software, an internet connection is required to access financial records on Tiller.

Pricing: Tiller has a free forever tier that is suitable for personal finance tracking and includes all core features. For small business use, premium paid tiers start at $9/month and provide additional invoicing and reporting features.

Some key stats about Tiller include:

– Used by over 500,000 users worldwide

– Integrates with over 30 banking institutions and credit cards for automatic import of transaction data

– Provides double-entry bookkeeping to keep financial records accurate

14. Spendee

Spendee is a free personal finance app that helps users track their income, expenses and budgets. It is available on both iOS and Android operating systems. The app aims to make money management simple with an intuitive user interface focused on spending tracking.

Pros: Some of the main advantages of using Spendee include:

– It’s completely free to use with no premium features or subscriptions required.

– Intuitive touch and swipe interface optimized for mobile use.

– Color-coded spending categories make it easy to see where money is going each month.

Cons: One potential disadvantage is that advanced budgeting and financial planning features are limited compared to paid alternatives. Basic forecasting and ‘what if’ scenario planning tools are available but more robust simulation capabilities are absent.

Pricing: Spendee is completely free to use with no hidden fees or subscriptions. There are no premium or ‘pro’ versions available – all core functionality is included in the free app download on iOS and Android.

Some key stats about Spendee include:

– Over 5 million downloads on the Google Play Store and Apple App Store combined.

– Active users in over 150 countries worldwide.

– Supports tracking income and expenses across multiple accounts and currencies.

15. Moneydance

Moneydance is a powerful yet easy to use personal finance app for managing personal finances across Mac, Windows, Linux, iPhone and iPad. With over 20 years of development, Moneydance is a mature personal finance software that provides personal and business accounting features.

Pros: Some key advantages of Moneydance include:

– Cross-platform usability – Can be used on multiple devices without repurchasing

– Robust reporting with double-entry accounting

– Integrates with online banking and bills for automatic transactions import

– Provides tools for budgeting, taxes, retirement and investment planning

Cons: A potential disadvantage is that Moneydance is a one-time purchase software rather than a subscription.

Pricing: Moneydance pricing is as follows:

– Standard Edition: $59.99 for a single-user perpetual license

– Professional Edition: $99.99 for a single-user perpetual license with added features like stock/funds import

Some key stats about Moneydance include:

– Available on Mac, Windows, Linux, iPhone and iPad operating systems

– Uses double-entry bookkeeping for accurate reports and accounting

– Supports online banking and bill payment integration

– Includes budgeting, tax planning, retirement planning and investment tracking tools

Conclusion

Whether you need basic budgeting assistance or more robust accounting features, there are great free personal finance software options available. Carefully considering your specific needs alongside customer feedback and popularity metrics can help you identify the best tool. Try some of the top-rated products mentioned here to find the one that works best for managing your money effectively in 2023.